A survey found that about three fifths of Americans believe that the United States is entering a recession

A new report from Affirm shows that as more and more households struggle to cope with rising prices and interest rates, most Americans mistakenly believe that the United States is in recession. Vishal Kapoor, the senior vice president in charge of products at the company, stated that people's confidence in the US economy is at a 'low point'.

From most indicators, the US economy is performing well, but many people do not think so.

A new survey conducted by Affirm on 2000 adults shows that approximately three fifths of Americans believe that the United States is currently in a recession.

This fintech company based in San Francisco found in a June survey that the majority of respondents indicated that the economic recession began about 15 months ago, in March of last year, and may continue until July 2025 due to rising costs and more difficult breakeven.

Vishal Kapoor, Senior Vice President of Product at Affirm, stated that persistent inflation has put heavy pressure on households. He said, "People's confidence in the US economy is at a low point, and consumers are urgently seeking ways to control their financial situation

Another survey conducted by The Guardian/Harris in May showed that 56% of respondents believe that the United States is in a recession, despite GDP growth in the past few years.

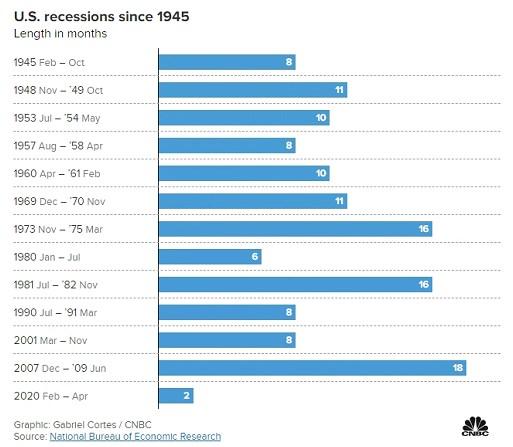

The official definition of an economic recession by the National Bureau of Economic Research (NBER) in the United States is "a significant decline in economic activity that affects the entire economy and lasts for more than a few months." There have been over ten economic recessions in the last century, some of which lasted for up to a year and a half. The last official recession was at the beginning of the COVID-19 epidemic in 2020.

However, regardless of the economic situation in the United States, many Americans are struggling with the sky high prices of daily necessities, and most have exhausted their savings and now rely on credit cards to make ends meet.

Economists have been working hard to address the growing disconnect between economic performance and people's perceptions of their own financial situation.

Joyce Chang, Chairman of J.P. Morgan's Global Research Department, stated at the CNBC Financial Advisors Summit in May that we are currently experiencing a 'climate recession'.

Chang said, "If you have a house or financial assets, you have done well, but you have overlooked a large part of the population." He mentioned the past few years: "Wealth creation has been concentrated among homeowners and high-income groups, but about one-third of the population may have been excluded, which is why there is a disconnect

As more and more families struggle to cope with rising prices and interest rates, new signs of financial strain have emerged.

More and more consumers are delaying credit card payments every month. The Federal Reserve Bank of New York reported in May this year that approximately 8.9% of credit card balances have become delinquent in the past year.

More middle-income families are expected to struggle in the coming months to repay their debts.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights