Bank of Canada is expected to cut interest rates by another 25 basis points this week, while the US and Canada may face an upward challenge of 1.3846!

On June 5th, the Bank of Canada announced a 25 basis point interest rate cut, lowering the interest rate to 4.75%, marking the first time in four years that the central bank has lowered interest rates. The last meeting also made it quite clear that if Canada's inflationary pressure continues to weaken, further interest rate cuts may occur this year.

On Wednesday, July 24th at 21:45, the Bank of Canada will hold an interest rate decision. According to swap traders, it is expected that the Bank of Canada will cut interest rates by 25 basis points for the second consecutive time on Wednesday, bringing the rate down to 4.50%; The Overnight Index (OIS) market reflects a 95% probability of the central bank cutting interest rates, with an annual rate cut of approximately 62 basis points (slightly higher than two rate cuts).

Market analyst Aaron Hill said that Wednesday's interest rate cut is unlikely to have a significant impact on the market, as the market has largely digested expectations of a rate cut.

Prior to the release of the latest data, the US dollar may rise against the Canadian dollar for the second consecutive week due to traders shorting the Canadian dollar. Forward guidance is crucial for this meeting as market participants seek insights into future easing cycles. However, some people claim that there are unlikely to be significant changes in Canada's GDP and inflation forecasts, and press conferences may repeat that the Canadian economy is cooling down, and the central bank's interest rate decisions are made in one meeting after another, reiterating that the Bank of Canada has not yet approached the limit below the Federal Reserve's policy spread - the market expects the Fed to cut interest rates by 25 basis points in September.

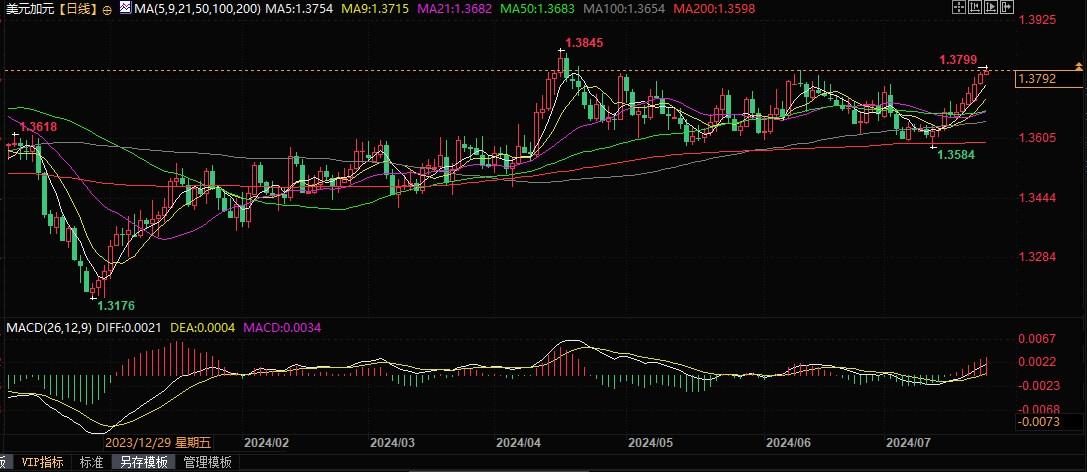

The US dollar has currently broken through the resistance level of 1.3775 against the Canadian dollar. According to Aaron Hill, influenced by the Bank of Canada's more dovish than expected stance on Wednesday, the US dollar against the Canadian dollar is expected to break through the upward trend, and look ahead to the high of 1.3846 in April 2024 and the high of 1.3855 on November 10, 2023.

Daily chart of USD/CAD exchange rate

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights