Trump will hold an indoor rally to hit Harris hard! What market impact will he have if he is re elected?

Republican presidential candidate Trump will hold his first campaign rally since President Biden withdrew over the weekend, and is expected to launch a fierce attack on his new Democratic opponent Harris. Analysis suggests that if Trump takes office again, the US dollar will fall and so-called safe haven and alternative assets will continue to rise. In addition, oil prices may face adverse effects.

Trump will hold an indoor rally to launch a fierce attack on Harris

According to informed sources, former US President Trump plans to stop holding outdoor rallies. Currently, his plan is to hold indoor rallies, but he may also participate in smaller outdoor activities,

At the event held in North Carolina, Trump may portray Harris as a proxy for Biden's economic and immigration policies, which have led to a decline in Biden's voter support.

Trump delivered a speech on Tuesday, emphasizing his campaign team's stance on border issues, stating that Harris bears partial responsibility for the record breaking influx of immigrants.

Biden appointed Harris to work with Central American countries to help curb immigration waves, but did not assign her the responsibility of maintaining border security.

Trump said in a conference call, "She is a radical leftist, and this country doesn't want to be destroyed by a radical leftist. She wants open borders. What she wants, no one wants

The rules committee of the Democratic National Committee approved a plan on Wednesday to formally nominate Harris as the presidential candidate as early as August 1st, and Harris will select his running mate before August 7th. The Democratic Party will hold its national convention in Chicago from August 19th to 22nd.

A poll completed on Tuesday showed that Harris leads Trump by a narrow margin of two percentage points in support, with 44% and 42% respectively. According to a poll conducted by SSRS, Trump leads Harris by 49% to 46%. The difference between the two results is within the margin of error of the public opinion survey.

Harris campaign chairman Jen OMalley Dillon stated in a memo released on Wednesday that the Democratic Party will target swing states such as Michigan, Wisconsin, Pennsylvania, North Carolina, Georgia, Arizona, and Nevada for competition, while the final weeks of Biden's campaign seem to be more focused on the Midwest.

OMalley Dillon wrote, "This election is now even more uncertain - although the Vice President is well-known, he is not as famous as Presidents Trump and Biden, especially in Democratic leaning districts

If Trump is elected, it will lead to a weakening of the US dollar and an increase in gold prices

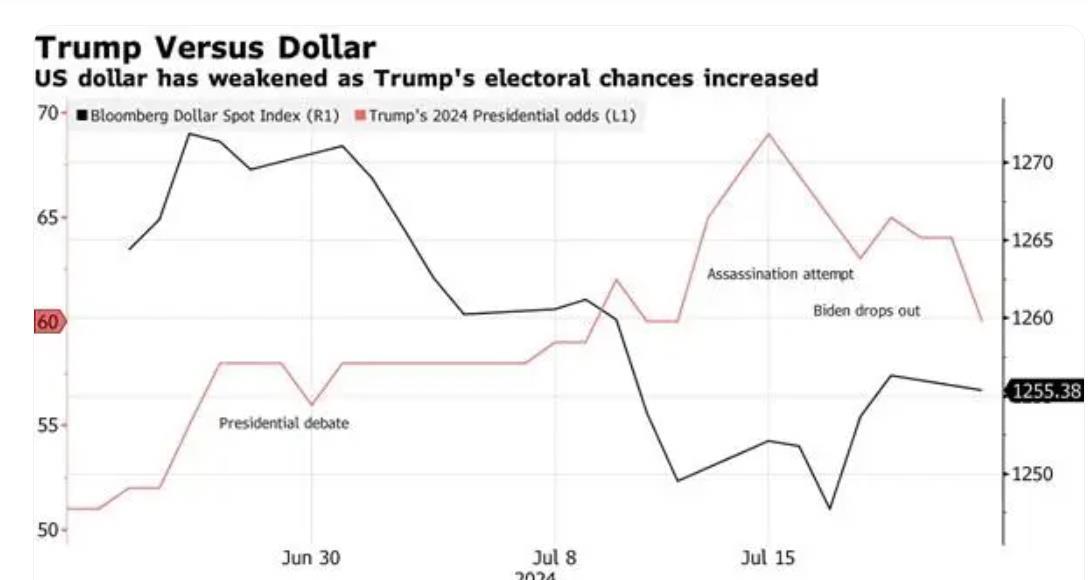

Analysis suggests that if Trump wins the 2024 US election, he may lead to a weakening of the US dollar. In recent weeks, concerns about the strengthening of the US dollar relative to currencies of trading partners such as Japan have become one of the key policy issues in Trump's campaign.

As shown in the figure below, as Trump's chances of winning the US election increase, the trend of the US dollar has declined. The red line represents the probability of Trump winning the election, while the black line represents the Bloomberg Dollar Index.

The decline of the US dollar will support high-risk assets such as gold. These assets have rebounded under a strategy known as the 'Trump trade'.

The market expects the US dollar to fall against other currencies, just like the situation during the Republican government, which may mean that so-called safe haven and alternative assets will continue to rise.

If we're talking about an environment where the Trump administration can achieve some of the goals they're talking about - inflationary policies, tariffs, a weaker dollar, a widening budget deficit, then safe haven or alternative assets may actually strengthen, "said Shaun Osborne, Chief Foreign Exchange Strategist at Scotiabank Canada

Osborne believes that if Trump wins, gold is another possible winner.

Antonio Cavarero, head of investment at Generali Asset Management, an investment company, said that it was expected that Trump's policies would be beneficial to both enterprises and the US stock market, but would increase the burden on the US debt situation. The company favors investing in government bonds in Europe, where the monetary policy path seems clearer

In addition, Citigroup analysts stated in a report that Trump's second presidential term may have a negative impact on oil prices. According to a report by Citigroup, the easing of relations between Russia and Ukraine may alleviate concerns about oil and gas supply, while the warming of relations between the United States and Saudi Arabia may allow OPEC+to return some idle oil production capacity to the market, and US oil and gas production may be stronger than ever before.

Daily chart of the US dollar index

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights