Gold up to 2900, operation requires patience!

This year's wind is blowing from AI and DeepSeek, whose full name is the Internet, and even lottery and stock selection have started to be used. The long short prediction of gold quickly spread to the industry, and in fact, writing articles and copywriting have started using this thing.

Fortunately, we have always had our own unique style, otherwise searching for data would have made editing articles much more tedious.

There is nothing wrong with being exposed to new things, but don't approach everything in the same way. As non industry professionals, these things are just gimmicks for ordinary people and have little substantive effect.

Good morning, you in front of the screen, the firecrackers that stayed up all night can be considered as bidding farewell to the New Year. Suddenly, things have become much quieter. It's time to calm down and embark on a new year of struggle!

In terms of gold, yesterday we were not afraid of the negative impact of CPI, but instead went for a bottoming out and rebound, and the bulls self repaired the market.

Similarly, when the daily chart turns from a single negative to a positive, this is what we emphasize. Do not rush to see a continuous negative after the negative line in a strong market.

The way to adjust prices is often to switch from single negative to positive.

Continue to maintain a 45 degree upward trend, which is still due to the fear of breaking through and accelerating. Of course, remember two points:

1. There is no risk in the first wave of early morning rise, but if there is more backtesting after a significant increase, the risk is high.

2. The European market is weak, don't buy too much in the US market, especially when the European market is falling and the US market is falling. Don't buy too much!

Compared to yesterday's technical points, we emphasized two words: watershed and time point.

1.2880 is a watershed, with a break in the European market and a decline in the US market.

3. Timing, the timing of the European market, strength is key.

Yesterday was a typical European market weakness, with CPI bearish sentiment continuing to retreat.

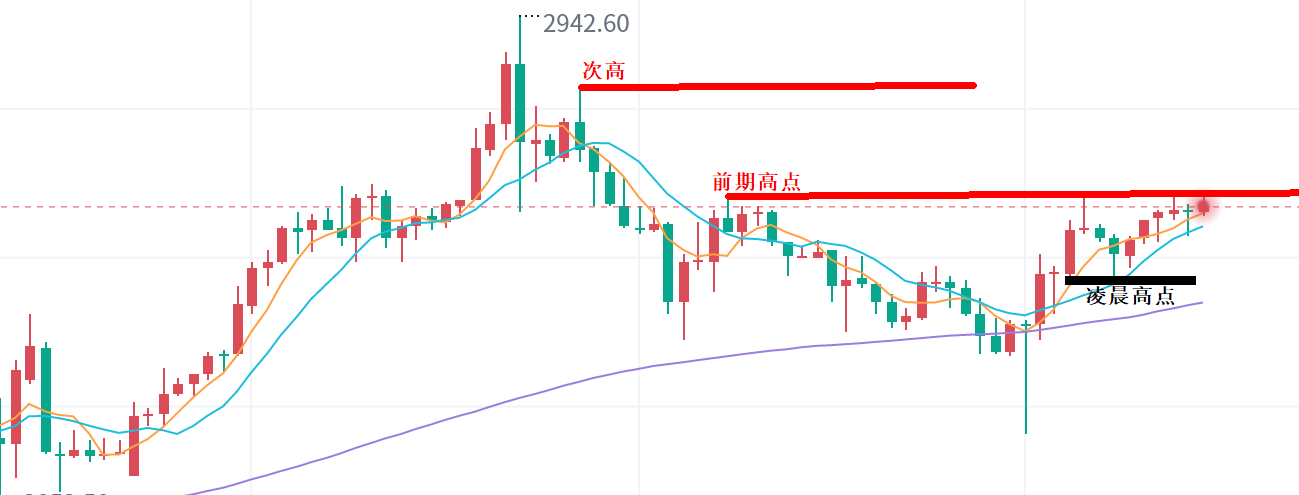

But the rhythm of the daily chart still bottomed out and rebounded, and the two key resistance levels also retreated, but they were eventually taken down, one at 2898 and the other at 2908. Both were two watershed points, and after retreating, they drew back and swallowed up.

As for today, focus on two points:

1. A strong bullish candlestick indicates a continuous upward trend.

2. It continued to rise in the morning, but yesterday's increase was significant, which makes it difficult to get started. The European market has become crucial and the timing is high.

It seems that the daily chart is fixed, but the position is not easy to find today.

Either continue to operate based on the strength of the European market. If the European market does not perform well, then the US market is bound to fluctuate. Pay attention to the 618 or early morning lows to see fluctuations.

If the European market is strong, the US market can follow the long position once.

This is why the timing is crucial when the position card cannot be reached.

For example:

There are also many people who are bullish today. If you ask about the position, it's either 2894 or 2890. The current price doesn't make sense to give this position. As I said, if the European market is strong, it's useless. If the European market is weak and it shakes, you're afraid. Just let you go directly, afraid that the European market won't rise and the trend won't be strong, you don't dare.

So, when there is a clear location, it is a matter of execution power.

When there is no clear location, it is definitely not easy to buy.

Continuing the strength of the European market and the layout of the American market. Short term resistance 2913-14.

The European market is rising, and the target for the US market is the high point of 2926-28 in the early stage. A second round of backtesting before the US market is sufficient. Wait and see at other times, the European market will not break through, and the US market will fluctuate. Operate according to the volatility trend!

The above only represents the author's personal views and opinions. Investment carries risks, and caution is required when entering the market

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights