Gold prices fluctuate at high levels, and the market's bullish sentiment is high

At the beginning of the Asian market on Monday (March 10th), spot gold fluctuated narrowly and is currently trading around $2915.60 per ounce. The gold price has been fluctuating at high levels for three consecutive trading days, but it still rose 1.85% on the weekly line, aided by the inflow of safe haven funds and the US employment report showing lower than expected job growth in February, suggesting that the Federal Reserve may cut interest rates this year. In addition, the unpredictable tariff policies of US President Trump have exacerbated uncertainty.

The US dollar index fell to a four month low last week and is expected to record its largest weekly decline since November 2022, making gold priced in US dollars cheaper for foreign buyers.

Bob Haberkorn, Senior Market Strategist at RJO Futures, said, "Weaker than expected data has given gold a slight boost... The current weakness of the US dollar this week has also helped

According to a report from the US Department of Labor, the US economy added 151000 new jobs in February, while economists surveyed by Reuters had previously expected an increase of 160000. The unemployment rate was 4.1%, with an expected increase of 4%.

Federal Reserve Chairman Powell stated earlier last Friday that the Fed will adopt a cautious attitude towards easing monetary policy, and added that the economy is currently "still in a good state".

Although gold is an inflation hedge tool, rising interest rates may weaken the attractiveness of non yield gold.

The market currently expects the Federal Reserve to resume interest rate cuts starting from June, with a cumulative rate cut of 76 basis points for the remaining time of the year.

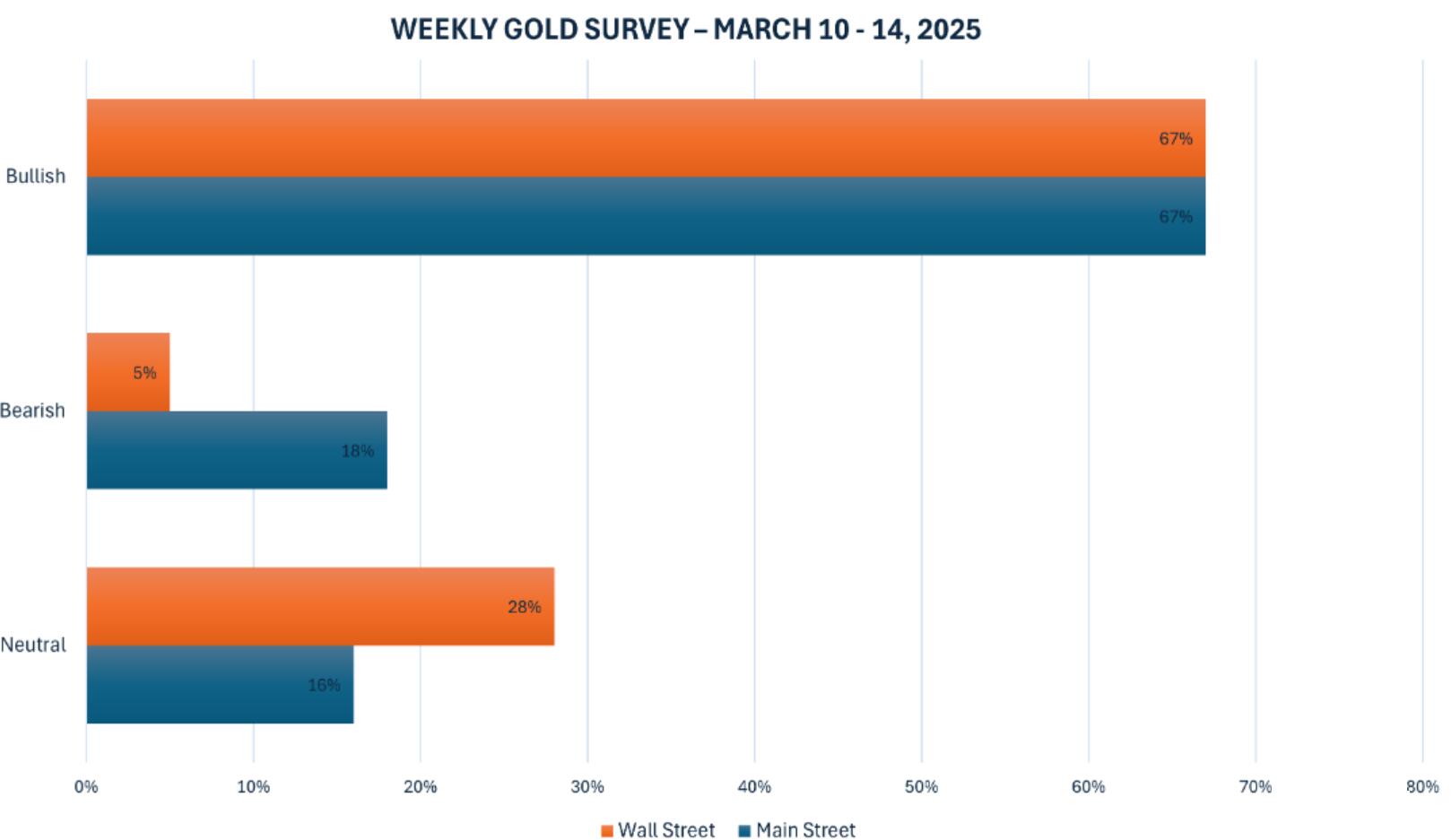

According to Kitco News' latest gold survey, the market's bullish sentiment has returned strongly, with two-thirds of industry experts and retail investors expecting gold prices to continue rising in the coming week.

Adrian Day, President of Adrian Day Asset Management, stated that the downward correction of gold has ended and its resilience is astonishing. It is expected that gold will once again hit a new historical high.

Rich Checkan, President of Asset Strategies International, believes that stock market volatility and inflation concerns will drive gold to continue rising.

According to Darin Newsom, Senior Market Analyst at Barchart, long-term investors are more inclined to seek safe haven assets in the current context of geopolitical turmoil and increased volatility, which benefits gold.

Colin Cieszynski, Chief Market Strategist at SIA Wealth Management, maintains a neutral stance and believes that gold is currently in a consolidation phase, awaiting further economic or political signals.

The focus of market attention is on the upcoming Federal Reserve meeting. Cieszynski stated that the Federal Reserve's forecast and non farm payroll data will be key driving factors. In addition, inflation reports and retail sales data will also provide more clues for the market. Although the Federal Reserve may maintain a wait-and-see attitude, the impact of tariff policies on the US dollar and the economy remains uncertain.

From a technical analysis perspective, Alex Kuptsikevich, Senior Market Analyst at FxPro, believes that gold prices have reversed upward since early March and will open up space towards $3180 after breaking through $2950.

Moor Analytics founder Michael Moor analyzed from a technical perspective that the long-term bull market trend of gold since 2015 is still continuing and may further rise in the future.

Overall, the rise in gold prices last week once again highlighted its importance as a safe haven asset. Although the market may face consolidation in the short term, geopolitical risks, inflation concerns, and uncertainty about Federal Reserve policies will continue to support gold demand.

This week we will also receive the February CPI data from the United States, and next week we will see the Federal Reserve's interest rate decision. Investors need to pay attention to changes in market expectations. In addition, this week we will closely monitor Trump's tariff policies, the Russia Ukraine situation, the US Ukraine mineral agreement, and other related news.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights