Multiple Asian countries urgently purchase energy from the United States! Can a billion dollar order resolve the Trump tariff crisis?

Faced with the threat of potential tariffs imposed by the Trump administration, many Asian countries are urgently adjusting their energy import strategies, attempting to reduce their trade surplus with the United States and avoid becoming a "target" of a trade war through large-scale purchases of American oil and natural gas. Indonesia, India, Pakistan, Thailand and other countries have all placed orders worth billions of dollars, and even considered participating in the Alaska LNG project in the United States. Whether this wave of energy diplomacy can be effective has become a new focus in the global trade landscape.

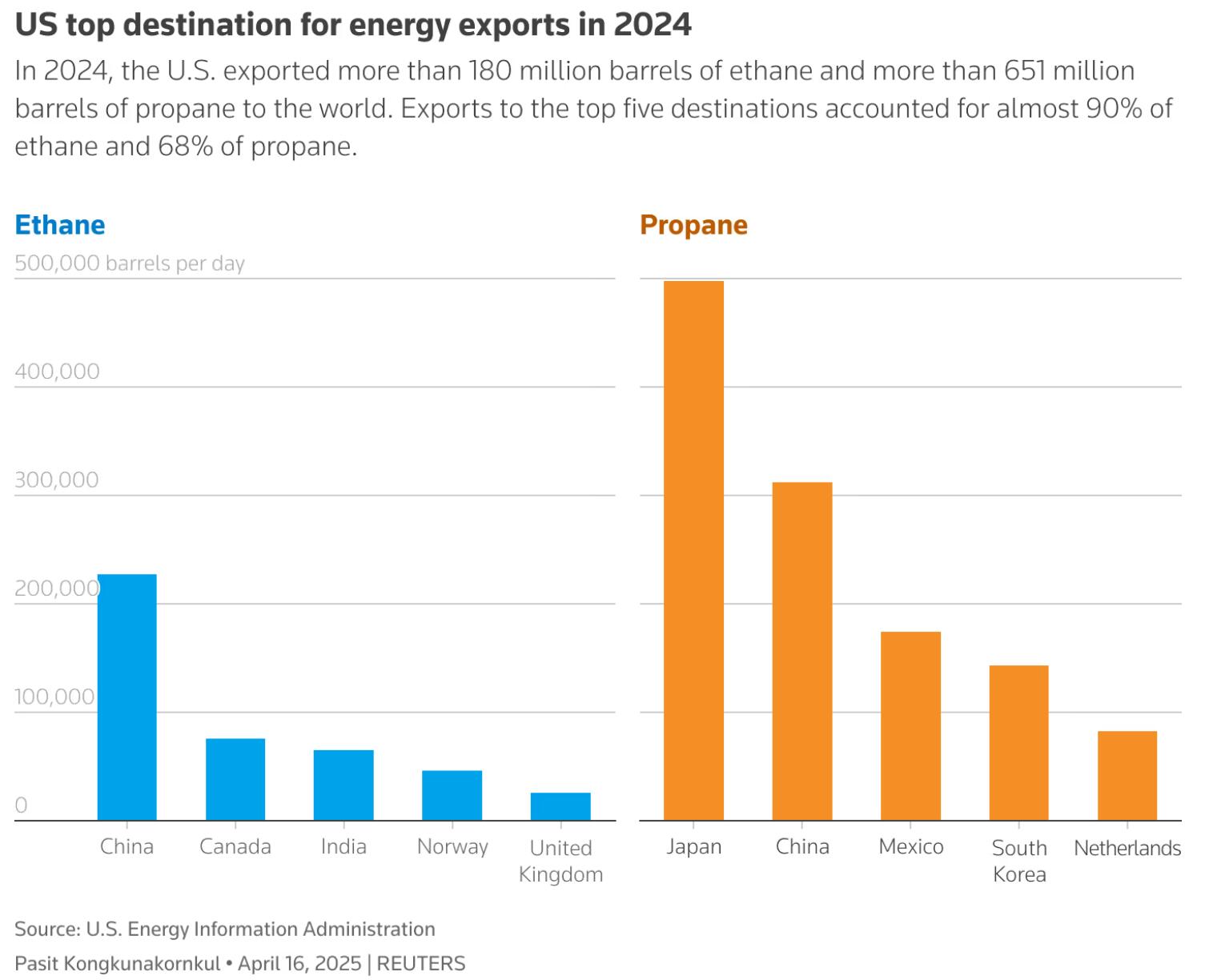

In 2024, the United States exported over 180 million barrels of ethane and over 651 million barrels of propane to the world, with exports to the top five destinations accounting for nearly 90% of ethane and 68% of propane. (Note: Ethane and propane are one of the components of crude oil.)

Image: Major destinations for US crude oil exports

Urgent action by countries, energy procurement becomes a bargaining chip in trade negotiations

1. Indonesia: $10 billion crude oil+LPG large order

Indonesian Energy Minister Bahlil Lahadalia publicly announced on Tuesday that the country plans to increase imports of approximately $10 billion in US crude oil and liquefied petroleum gas (LPG) to ease trade frictions. The Indonesian government is considering adjusting import quotas to allow more American energy to enter the domestic market. This measure is clearly aimed at seeking more favorable conditions in tariff negotiations.

2. Pakistan: First import of US crude oil

Pakistan, which has long relied on Middle Eastern oil, is now considering importing crude oil from the United States for the first time. According to government sources and refinery executives, Pakistan plans to purchase approximately $1 billion worth of US oil, which is a significant proportion of its current oil imports. This strategic adjustment aims to balance the US Pakistan trade relationship and avoid being hit by Trump's tariff stick.

3. India: Abolish LNG import taxes and expand procurement

Four Indian government and industry sources have revealed that New Delhi is considering lifting import tariffs on liquefied natural gas (LNG) from the United States and may further reduce tariffs on ethane and LPG. India is a potential major buyer of LNG from the United States, which can meet domestic energy demand and reduce the trade surplus with the United States, killing two birds with one stone.

4. Thailand: 5-year LNG+Ethane Import Plan

The Thai government announced on Wednesday that it will significantly increase its purchases of LNG and ethane from the United States over the next five years. In addition to the original plan to import 15 million tons of LNG within 15 years starting from 2026, Thailand will also import an additional 1 million tons of US LNG (worth $500 million) over the next five years and plan to purchase 400000 tons of US ethane (worth $100 million) over the next four years.

5. Alaska LNG project: Trump's push, Japan and South Korea may join

The Trump administration is actively promoting the $44 billion Alaska LNG project and hopes that Japan and South Korea will participate in investment. The project plans to transport natural gas to southern Alaska through a 1300 kilometer pipeline and export it to Asia in the form of LNG. At present, Mitsubishi Corporation of Japan has expressed its consideration of investment, and South Korean officials also plan to go to the United States for negotiations. If successful, the project will significantly enhance the United States' energy export capacity to Asia.

Summary: Can Energy Diplomacy Resolve Trade War Risks?

The collective shift of Asian countries towards the US energy market is not only a helpless move under the threat of Trump's tariffs, but also an important signal of the reshaping of the global energy trade pattern. In the short term, these procurement plans may help some countries alleviate the pressure of trade surplus, but in the long run, whether they can truly avoid tariff shocks still depends on the policy direction of the Trump administration.

key problem:

Can American energy truly replace Middle Eastern supply? Asian countries have long relied on Middle Eastern oil and need to adjust their infrastructure and supply chains to shift towards American energy.

Will Trump buy it? Even if Asian countries increase their procurement, Trump may still continue to pressure them on the grounds of "excessive trade surplus".

The geopolitical impact is far-reaching. If Asian countries significantly reduce imports from the Middle East, it may affect the market control of OPEC+and change the global energy power structure.

This energy procurement wave is not only a trade game, but also a key turning point in rewriting the global energy landscape. In the coming months, whether orders from Asian countries can be fulfilled and whether Trump will adjust tariff policies will become the core issues of market concern.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights