Is the inverted yield curve of US Treasury bonds about to reverse, and has the US escaped an economic recession?

The inverted yield curve of US Treasury bonds may be nearing its end. This inversion is the longest and deepest in history, and a key bond market signal that an economic recession is imminent.

Although an inverted yield curve usually indicates an economic recession, there is controversy over the predictive ability of this indicator this time, with optimism that the United States can avoid long-term economic difficulties. In recent weeks, some indicators have shown a slowdown in the US economy, but economic growth remains strong due to the resilience of the labor market.

I don't think there's an economic recession right now, I think the situation this time is very different, "said Phil Blancato, Chief Market Strategist at Osaic

Investors pay attention to the shape of the US Treasury yield curve as it reveals market expectations for monetary policy and the economy. According to data from Deutsche Bank, in the past 70 years, if there has been an inverted yield curve (short-term bond yields higher than long-term bond yields), 9 out of 10 times it is a precursor to an economic recession.

Last year, several Wall Street firms predicted that the US economy would fall into a recession due to rising borrowing costs, but the sustained economic resilience shattered these predictions. Economists surveyed this month predict that the US economy will continue to expand in the next two years. Most bond strategists surveyed earlier this year stated that the curve is no longer a reliable recession signal.

Lawrence Gillum, Chief Fixed Income Strategist at LPL Financial, said, "Some indicators may not be as perfect as the data shows, and this is one of them. Currently, the reduction in yield curve inversion is not due to an economic recession, but simply a return to a normal upward sloping yield curve

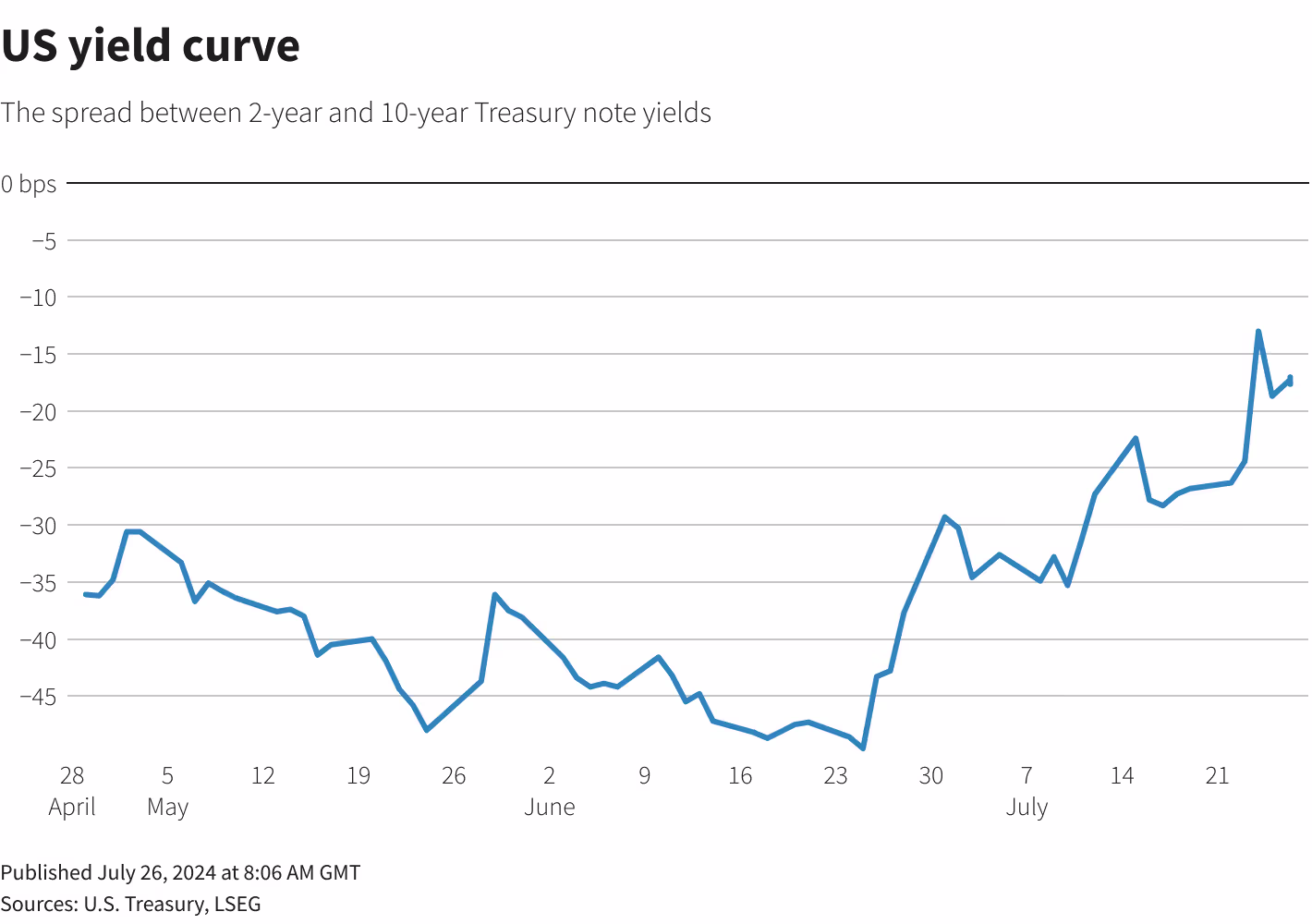

The yield curves of two-year and 10-year government bonds have been continuously inverted since early July 2022, surpassing the record set in 1978. This inversion occurred after the Federal Reserve began its interest rate hike cycle in March 2022 to curb inflation.

In recent weeks, under signs of economic cooling, this curve has become steeper - meaning that the difference between two-year and 10-year yields has narrowed. According to Tradeweb data, the yield spread hit negative 14.5 basis points last Wednesday, with the lowest degree of inversion since July 2022. Last Friday, the yield spread was negative 18.5 basis points.

Figure: Yield curve of US Treasury bonds

The difference in yields usually turns positive as the economic slowdown leads to market expectations that the Federal Reserve will cut interest rates, resulting in short-term bonds rising more than long-term bonds.

In the case of only moderate signs of economic slowdown, the degree of inversion of the yield curve may ease, as is currently the case, but some analysts warn that recent performance of the yield curve suggests that the US economy may still shrink.

Last Thursday, Jim Reid, a strategist at Deutsche Bank, stated in a report that "in recent cycles, the end of the yield curve inversion and the subsequent steepening usually occur shortly before an economic recession, so close attention is needed

In every case investigated by Deutsche Bank, the curve steepens again before the economic recession begins.

According to an analysis report released by Deutsche Bank last year, in the past four economic recessions (2020, 2007-2009, 2001, and 1990-1991), the difference between the yields of two-year and 10-year government bonds had already turned positive at the time of the economic recession. In these four recessions, the interval between the inversion of the yield curve and the beginning of the economic recession varies, approximately between two to six months.

George Cipolloni, portfolio manager at Penn Mutual Asset Management, said, "We are currently at a critical juncture because the yield curve is becoming steeper, which is usually when we encounter trouble

Campbell Harvey, a finance professor at Duke University, was the first to propose the view that the yield curve predicts future economic performance. He stated that another highly anticipated part of the curve, the three-month yield and 10-year yield, also experienced an inverted reversal before the start of the last four economic recessions in the United States.

The curve showed an inversion in November 2022 and remained in a deep inversion state of negative 109 basis points as of last Friday. He observed that the longest interval between a three-month/10-year yield curve inversion and an economic recession is 22 months.

He said, "It's too early to determine if this signal is invalid now

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights