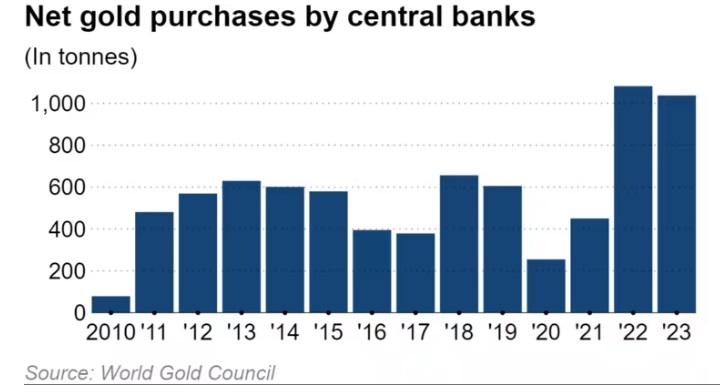

Central banks around the world are diversifying their investments in the US dollar, with record gold purchases in the first half of the year

Japan's Nikkei Asia reported on Sunday (August 11) that central banks around the world are diversifying their investments in the US dollar and adding a "stateless currency" - gold - to their foreign exchange reserves in response to escalating geopolitical tensions and global economic uncertainty.

The proportion of the US dollar in global foreign exchange reserves has significantly decreased from over 70% at the beginning of this century. At present, the share of the US dollar in foreign exchange reserves held by central banks and governments around the world is at a historical low.

Russia's attack on Ukraine has triggered severe sanctions from the United States, excluding Moscow from the global financial system based on the US dollar and prompting emerging economies to accumulate gold that is not tied to any specific country.

Foreign exchange reserves are assets used by central banks of various countries to repay foreign debts and pay for import costs in emergency situations. They also provide funding for currency intervention. Many of these foreign exchange reserves are usually denominated in US dollars, and are usually convertible US treasury bond bonds.

According to data from the International Monetary Fund (IMF), as of March 2024, the total balance of global foreign exchange reserves was $12.3499 trillion, with the US dollar accounting for 58.9% in terms of currency allocation.

This is slightly up 0.4% from the historical low at the end of 2023, but still close to the historical low. By contrast, the share of the US dollar in the early 21st century exceeded 70%.

In response to the Russia-Ukraine conflict, the United States, Europe and Japan tried to exclude Russia from the US dollar settlement network and frozen the foreign exchange reserves of the Russian Central Bank deposited in other central banks.

Daisuke Karakama, Chief Market Economist of Mizuho Bank, said that this measure has led countries around the world to diversify their foreign exchange reserves from the US dollar and may favor assets such as the Japanese yen.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights