The closing of yen carry trades has eased in the short term, but may continue in the medium to long term

After receiving warnings about risks, investors are now asking whether the closing of yen carry trades has been completed and how far it may go?

The 2024 Global Outlook (released on December 4, 2023) warns of the risks associated with closing out yen carry trades (borrowing at zero or very low interest rates in Japan and investing in assets with higher expected returns) that shook global markets last week.

The report points out that "according to data from the International Monetary Fund (IMF), decades of accumulated current account surpluses have made Japan the world's largest net international investment position, with overseas investments of $3.3 trillion. Although the United States has the world's largest economic influence, Japan may have the greatest influence in asset markets due to these account surpluses. If the Bank of Japan starts to significantly tighten monetary policy next year, as implied by the end of the yield curve control (YCC) at the Bank of Japan meeting in October last year, global investors may feel a reversal of decades of capital outflows

In less than a month (July 10th to August 5th), the Japanese yen rose 14% against the US dollar, causing asset depreciation relative to the value of yen denominated loans used to purchase assets, forcing some investors to liquidate their positions. On August 5th, the global market experienced severe fluctuations, indicating the possibility of forced selling, similar to extensive margin call notifications. Multiple factors may have jointly driven the recent trend of the Japanese yen. On July 31st, the Bank of Japan unexpectedly raised interest rates, exceeding expectations, and promised to further raise rates while implementing a faster than expected quantitative tightening policy (reducing assets purchased during more than a decade of quantitative easing). In addition, deteriorating US economic data and disappointing data from some large tech companies have put pressure on the US dollar and stock market.

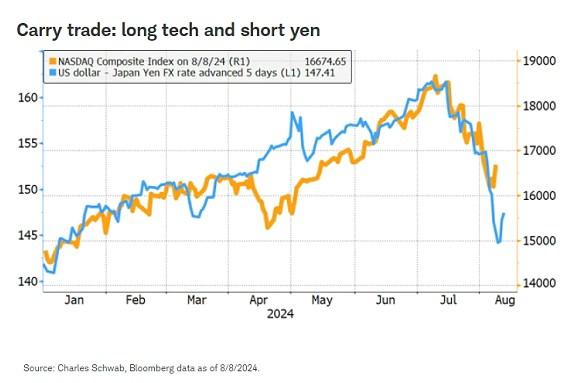

Going long on technology stocks and short on the Japanese yen are two popular trading methods in recent years. People can borrow Japanese yen at the cheapest interest rate, which means that the yen has always been the cheapest primary financing currency. Due to the continuous profitability of technology stocks, it is not difficult to imagine that a large portion of short selling of the Japanese yen has flowed to US technology stocks. The following chart shows a similar trend of the US dollar against the Japanese yen, as well as the tech dominated Nasdaq, highlighting the possibility of carry trades providing funding for tech stock investments, but such trades may also provide funding for buying in other markets.

Image: Carry trades: long technology stocks, short yen (yellow line represents Nasdaq, blue line represents US Japan exchange rate)

Various media outlets have hinted that the Federal Reserve may take emergency interest rate cuts before its September interest rate decision. Although weak economic and employment data may prompt the Federal Reserve to join other central banks in cutting interest rates, this move is unlikely to stop closing positions. The emergency interest rate cuts by the Federal Reserve often lead to a strengthening of the yen against the US dollar, exacerbating the liquidation of carry trades rather than easing them.

Another possibility is for Japanese officials to intervene to limit the appreciation of the yen. However, previous government interventions to limit exchange rate fluctuations often failed to change the trend of the yen to a large extent, only slowing it down. The Deputy Governor of the Bank of Japan has hinted that further changes in interest rates will take into account the volatility of financial markets, which may have slowed down liquidation in the short term.

The resurgence of technology stocks may revive carry trades. However, there will be many issues that will put pressure on the operation and may maintain volatility: the profit prospects of leading companies such as Alphabet and Tesla are not satisfactory, Buffett's holdings of Apple have been reduced by nearly half, recent economic data (including US employment reports) are lower than expected, uncertainty in global elections, and intensifying geopolitical conflicts.

The global stock market crash on August 5th saw a reversal the next day. What's the bad news? The recovery of the stock market does not guarantee that risks have been eliminated. People believe that the most intense fluctuations associated with closing short-term yen trades may have passed, but data tracking needs to continue. For over a decade, people have borrowed Japanese yen at low prices and may have invested in high-risk assets such as US technology stocks. Ultimately, people cannot know how long or how far the drag on the stock and foreign exchange markets from the 2024 carry trade liquidation will last in the medium to long term.

Now it seems that stock markets that are less affected by technology stocks, the US dollar, and the Japanese yen, as well as those with stable economic backgrounds and valuations below average, are most likely to better resist further liquidation of yen carry trades. On Monday, August 5th, European stock markets performed much better than those in the United States and Japan, possibly due to these reasons. The panic trend in the market reminds us of how cautious portfolio diversification and risk exposure assessment are.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights