Analyst: Gold and silver are expected to rise before the end of this year, but the outlook for "Copper Doctor" is difficult to be optimistic

The performance of gold prices in 2024 is the best in decades, reaching a historic high of $2483.35. Although the gold price has struggled to break through $2480 three times, an analyst said that it is only a matter of time before the gold price successfully breaks through $2500.

Scott Bauer, CEO of Prosper Trading Company, said, "The metal market has fluctuated greatly this year, with gold, silver, and copper experiencing the greatest volatility." "With the soaring demand for gold and silver, the prospects for precious and industrial metals seem optimistic, but Dr. Copper may have already left this group

Bauer pointed out that one of the biggest driving factors for the bullish outlook of precious metals is market expectations that the Federal Reserve will cut interest rates. The Chicago Mercantile Exchange (CME) Federal Reserve Watch tool shows that Wall Street expects a 100% chance of a rate cut in September, with a "probability of further rate cuts in November and December of around 80%.

He said, "Historically, commodities have been seen as a hedge against inflation, but the US dollar rose with these metals during the same period, although it fell slightly in August

He added, "As the US dollar weakens, commodities such as metals and oil typically perform well because more commodities can be purchased with the US dollar, while traders who use non US dollar currencies can purchase more US dollars with their own currency. This comes down to the fundamental economic principle of supply and demand. These three metals are either currently in short supply or may be in short supply in the near future

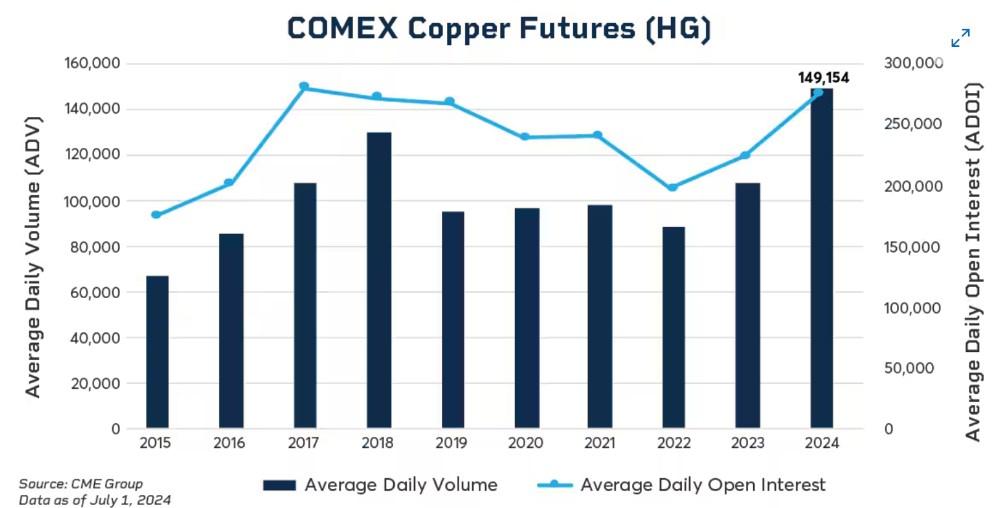

Bauer pointed out that copper prices hit a historic high in May and have since fallen by about 20%. He said, "Due to the increased demand for copper in the manufacturing of artificial intelligence chips and electric vehicle production, COMEX copper futures have reached a record level of participation this year as market participants perceive potential supply lags

Figure: COMEX copper futures (black bar: daily trading volume, blue line: daily open interest volume) (left is the daily trading volume scale, right is the daily open interest volume scale)

He pointed out, "However, the recent sell-off of global technology stocks and doubts about the growth of the artificial intelligence industry have severely hit copper prices. Most of the demand for copper comes from Asia, where recent economic data shows that there has not been a recovery yet. If orders and demand in Asia continue to be weak, this may indicate that this decline is not just temporary

Speaking of gold, Bauer stated that the prospect of interest rate cuts and ongoing geopolitical risks will be favorable factors for gold.

He pointed out, "In this ongoing uncertainty, as more and more market participants turn to safe haven assets, the daily trading volume of micro gold futures increased by 68% in July, reaching 106000 contracts. In addition, central banks around the world have been purchasing gold at record levels. According to data from the World Gold Council (WGC), central banks purchased 1037 tons of gold in 2023. WGC's annual survey data shows that 29% of central banks expect their gold reserves to increase in the next 12 months

As for silver, Bauer emphasized, "Due to strong demand for emerging technologies, especially considering its ability to conduct electricity faster than any other metal, micro silver futures have risen this year

He pointed out, "The Silver Institute report states that there will be a shortage of 184.3 million ounces in 2023 due to strong industrial demand. Demand continues to exceed supply, and due to the expanding industrial demand for silver, the shortage may continue beyond 2024

Bauer pointed out that the gold to silver ratio indicates that this gray metal will experience a rebound. He said, "Historically, when this ratio exceeds 80, it indicates that silver is relatively cheap compared to gold. The last three times this has happened, silver prices have risen by 40%, 300%, and 400% respectively. When this ratio drops below 20, it indicates that gold is relatively cheap compared to silver

Figure: Gold and Silver Price Ratio

He added, "Currently, this ratio is still at a historical high. The most recent example of silver being cheaper than gold was at the beginning of the pandemic in 2020, when the record breaking gold to silver ratio reached 123:1, but then quickly fell back to nearly 60:1

Bauer concluded, "The possibility of interest rate cuts and ongoing geopolitical events provide potential momentum for the upward trend of gold and silver before the end of the year. Copper, which is more closely linked to Asian economic data, may find itself relatively lagging behind in the near future.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights