How do foreign exchange investors make price difference contracts?

What is a price difference contract?

For foreign exchange and financial traders, contracts for differences are a convenient and popular tool. But if you still have a partial understanding of it, you may be curious about what a price difference contract is?

This means that you can use leverage to use less funds (margin) to increase the number of contracts purchased.

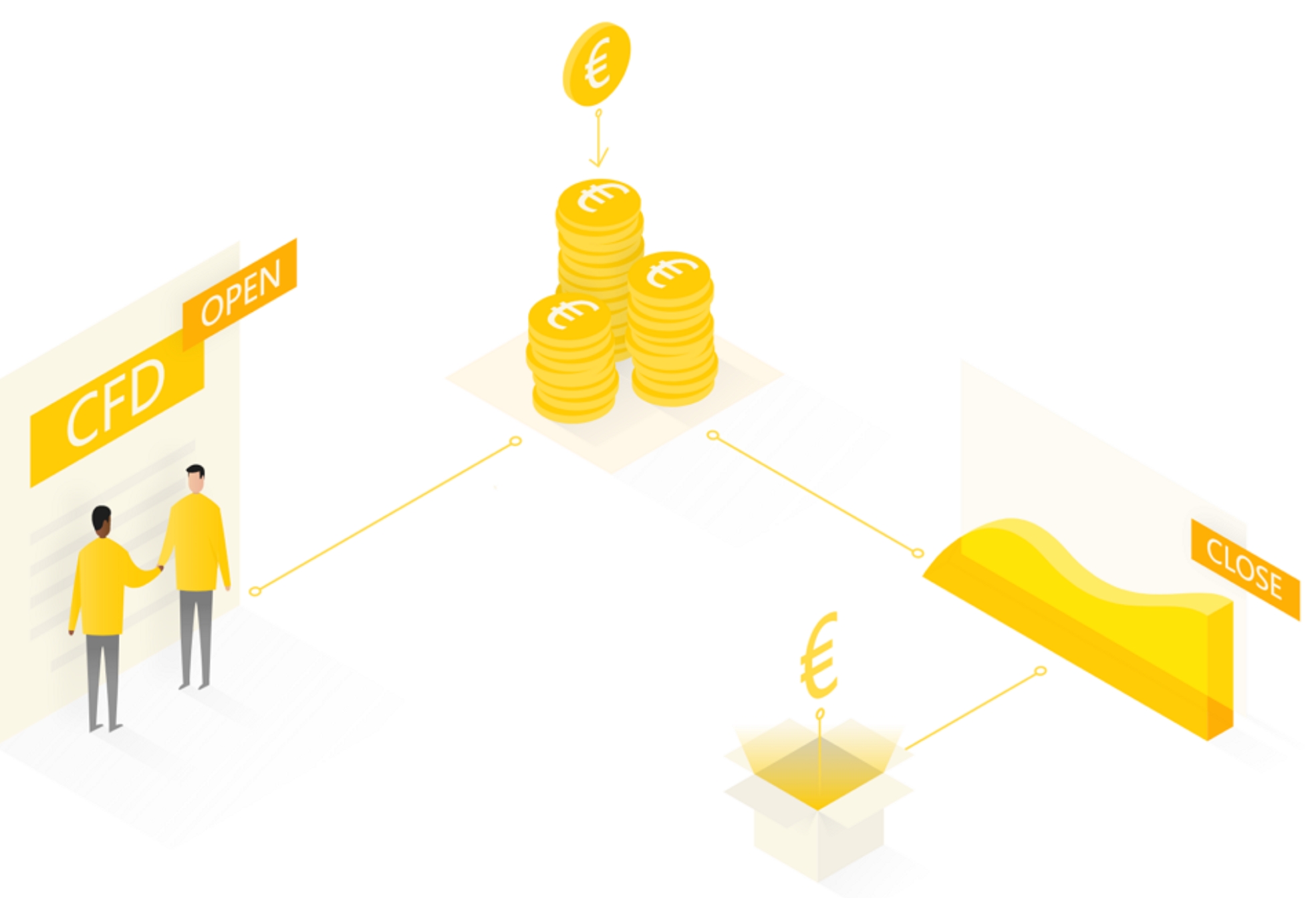

Contract for Difference (CFD) is an investment behavior in which the buyer and seller enter into a trading contract to calculate the difference between the opening value and closing value of a specific underlying financial product.

All leveraged trading products, similar to price difference contracts, can help you use your investment funds more effectively. However, please note that compared to non leveraged trading products, leveraged trading may cause significant profits or losses to your investment.

Price difference contracts are generally traded with margin, and you only need to deposit a portion of the total value of the trading product contract to trade. Compared to traditional cash trading models, this allows you to more effectively utilize limited funds to increase investment potential. Your profit or loss depends on the price difference between buying and selling trading products.

How do foreign exchange traders invest in contracts for price differences?

Contract for Difference (CFD) trading is a convenient way for foreign exchange traders to engage in speculative trading in the most popular financial markets such as foreign exchange or stocks. If you want to invest in the trend of the US dollar against the euro, or if you feel that Facebook stocks will quickly rise, instead of spending thousands of dollars to buy stocks, you can buy price difference contracts. Contracts for Difference (CFD) allow you to invest a small portion of a certain total value. The standard number of hands in foreign exchange trading is 100000 currency units (US dollars, euros, etc.), but you can also trade mini hands (10000) and mini hands (1000). When you open a trading account, the funds deposited into the account can be used as funds for trading price difference contracts, and you can use leverage for trading.

For example, with a leverage of 10:1, you can invest $1000 to make an investment worth $10000. The $1000 here is called margin (deposit), and a 10:1 leverage means that profits or losses will be based on the value of $10000. Therefore, if the value increases by 2% to $10200 and you choose to close the position, you will profit $200. Because the initial margin is $1000, you will profit $200 from the $1000 margin, which is equivalent to a 20% return rate. However, if the value drops by 2%, a loss of $200 would also mean a loss of 20%.

This simple example did not take into account transaction related costs. Some brokers may charge commissions, margin, or even spreads as transaction fees.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights