Crude Oil Market Weekly Report: Where Should Oil Prices Go amidst the Strong US Dollar and Geopolitical Tensions

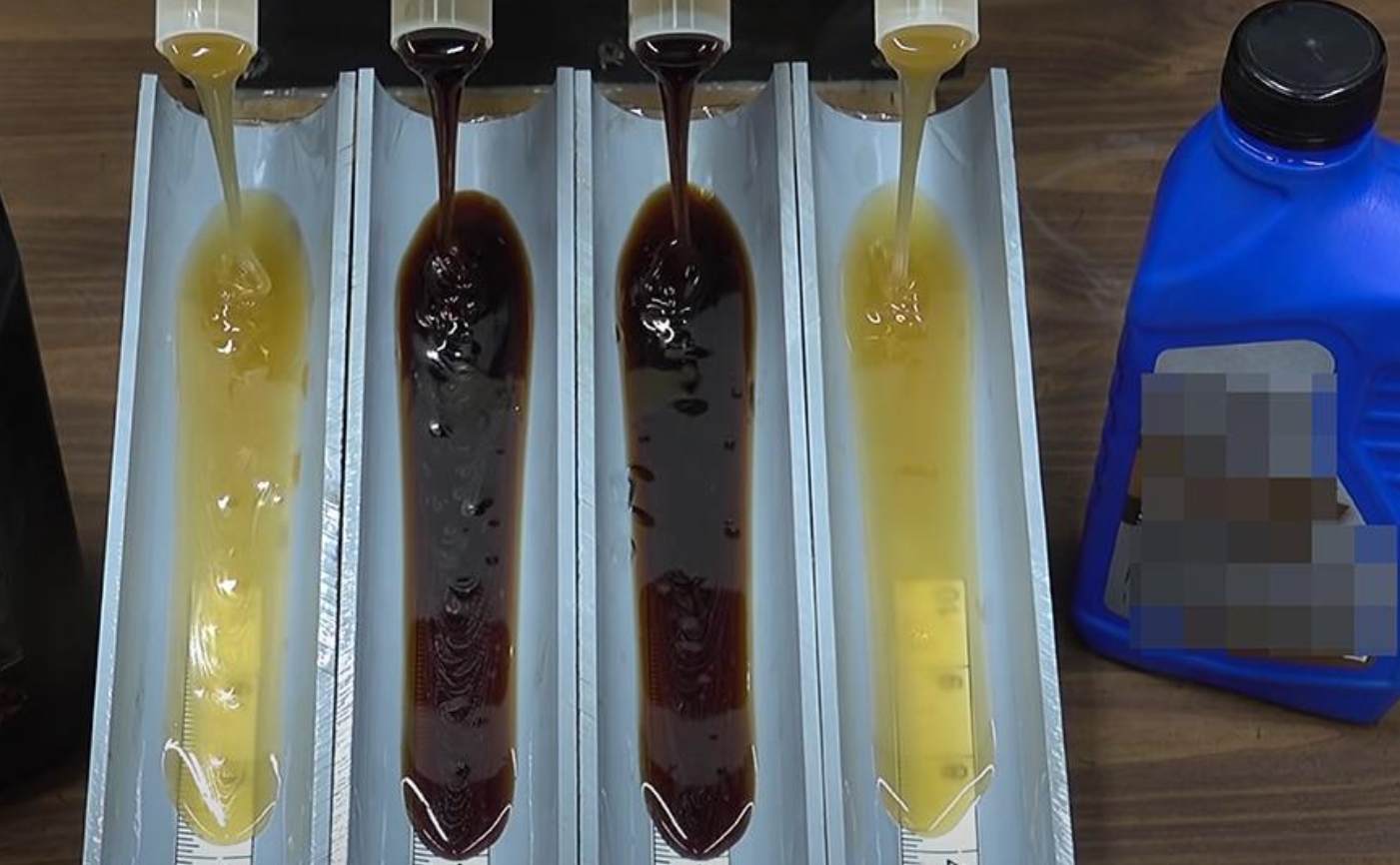

This week, the crude oil market experienced a series of fluctuations, ultimately ending with a slight decline in Brent crude oil and WTI crude oil futures prices. Despite facing pressure from a strengthening US dollar, the two major crude oil indicators still achieved an overall increase of about 3% this week. The increase in US oil demand and the decrease in fuel inventories have provided support for the crude oil market, while geopolitical tensions have added uncertainty to the market.

The strength of the US dollar has had a significant impact on the crude oil market. The US dollar has hit a seven week high against major currencies, causing crude oil denominated in US dollars to be more expensive for holders of other currencies, potentially suppressing global oil demand. However, the strong performance of economic activity in the United States, especially with commercial activity reaching a 26 month high in June, has provided some support for oil demand.

WTI crude oil rose 3.23% this week to $80.59 per barrel. Brent crude oil rose 2.53% this week to $84.18 per barrel.

Supply and demand dynamics:

According to data from the US Energy Information Agency (EIA), the total supply of petroleum products increased significantly last week, reaching 21.1 million barrels per day, indicating that the US oil market is tightening. The arrival of the summer driving season and the decrease in inventory have driven up the prices of gasoline futures in the United States, reflecting an increase in demand.

Geopolitical factors:

The geopolitical tensions, especially the conflict between Israel and Lebanon, as well as the attacks by the Houser militants in the Red Sea, have brought additional pressure to the crude oil market. These events have increased market concerns about supply disruptions, which may put upward pressure on oil prices.

Analyst's viewpoint:

Renowned institutional analyst Vivek Dhar pointed out that EIA data indicates that the US oil market is tightening, while other banks such as Goldman Sachs, Dutch International, and Citigroup have also pointed out market deficits. Citigroup mentioned in its report that geopolitical risks remain prominent and may further boost oil prices.

Kamayoun Falakshahi, a senior analyst at Kpler, predicts that the increase in summer oil demand and the intensification of geopolitical tensions in the Middle East may push Brent crude oil close to $90 per barrel.

The performance of the crude oil market this week reflects the combined effect of various factors, including the strengthening of the US dollar, rising US oil demand, geopolitical tensions, and market expectations for supply and demand dynamics. Despite facing some challenges, overall, the market remains optimistic about the long-term trend of crude oil prices. Investors should closely monitor the development of global economic and political events, as well as how they affect the supply-demand balance and price trends of the crude oil market.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights