Positive oil prices! Standard Chartered says oil demand is not as pessimistic

Standard Chartered Bank stated that oil demand is not as pessimistic as the market imagines. Concerns about Asian demand continue to dominate the oil market, but Standard Chartered Bank predicts that global oil demand will continue to grow in 2024, staying above 103 million barrels per day.

Due to the easing of geopolitical concerns and seemingly endless demand worries, oil prices have fallen back after rising in recent weeks. On Monday, the US Secretary of State announced that Israeli Prime Minister Netanyahu had accepted a ceasefire proposal to end the war in Gaza, but on Thursday, White House sources reported that such an agreement was once again out of reach.

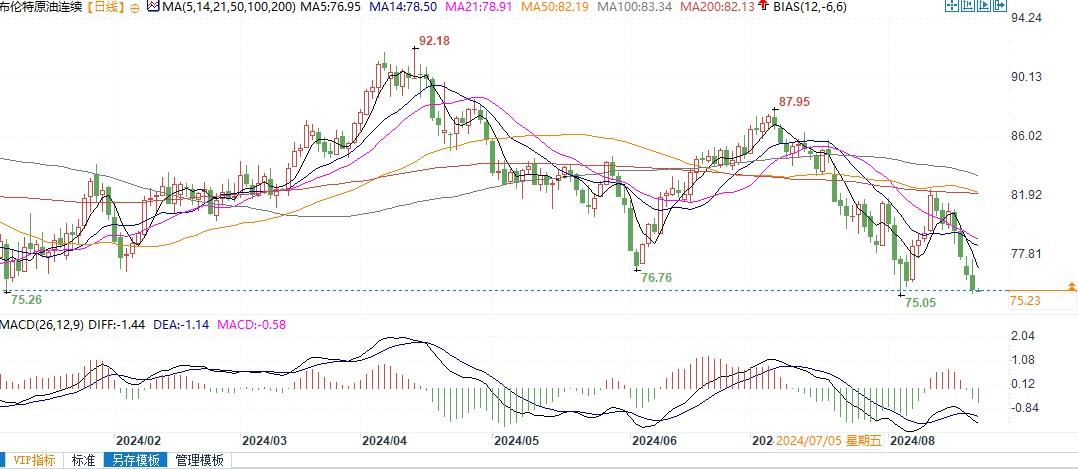

On Wednesday, crude oil futures fell sharply, with WTI crude oil prices dropping to $72 per barrel and Brent crude oil prices dropping to $75 per barrel at one point. The prospect of weak demand in Asia offsets the benefits brought by supply risks.

After the release of the Joint Oil Data Initiative (JODI) data on August 19th, Standard Chartered Bank's commodity analysts have been able to measure global crude oil demand.

According to data from Standard Chartered Bank, global oil demand reached a record high of 103.01 million barrels per day in June. According to JODI's revision, Standard Chartered Bank estimates the demand for May to be 102.68 million barrels per day, the second highest monthly average level after June. The average demand growth in the second quarter was 1.521 million barrels per day, which is close to Standard Chartered Bank's forecast for full year growth in 2024 (1.514 million barrels per day).

The only pessimistic data point in the report is that demand growth has been slowing down, with demand growth in June reaching 788000 barrels per day, lower than May's 1.267 million barrels per day and April's 2.129 million barrels per day. Standard Chartered Bank predicts that global demand will remain above 103 million barrels per day for the remainder of 2024, and then drop to 101.9 million barrels per day in January 2025 due to seasonal factors.

At the same time, global crude oil supply growth remains weak, with a supply increase of 160000 barrels per day in June, reaching 1020.97 million barrels per day, far below the historical high of 1031.62 million barrels per day in December 2023.

The limited global supply growth can largely be attributed to the weak growth of non OPEC countries, especially the United States. Due to shale oil producers' adherence to production discipline and their goal of returning capital to shareholders, oil production in the United States will only increase by 2.3% this year. So far this year, the average crude oil export volume from US ports has been 4.2 million barrels per day, a year-on-year increase of only 3.5%, compared to a year-on-year increase of 13.5% in 2023. This year's growth rate is the lowest since 2015, when the country lifted a 40 year federal ban on domestic crude oil exports.

American shale oil producers are simply unwilling to extract more oil. Shale wells typically experience high decline rates shortly after production, which means that additional completion is needed to offset the decline rates of existing wells in order to maintain production. Earlier this year, Standard Chartered Bank reported that the number of horizontal drilling rigs has sharply declined since early 2023, and after remaining stable for the past six months, it is currently 20% lower than its post pandemic peak. Analysts point out that although the completion of previous drilling and technological changes can have a offsetting effect, a significant decline in activity often leads to lagging growth.

Brent crude oil daily chart

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights