The US dollar once fell below the 101 level and hit a new low in nearly half a month

On Wednesday (August 21), the Federal Reserve released its latest meeting minutes and significantly lowered US non farm payroll data, indicating that the Fed's interest rate cut in September is "certain". The US dollar fell to its lowest level since December last year and briefly missed the 101 mark at 100.92.

As of the close, the US dollar index is now at 101.18, a decrease of 0.19%.

The minutes of Wednesday's Federal Reserve meeting showed that Federal Reserve officials had a strong inclination to cut interest rates at the September policy meeting last month, with several officials even willing to immediately reduce borrowing costs. Federal Reserve officials kept interest rates unchanged at the FOMC meeting last month, but opened the door for a rate cut at the September 17-18 meeting. The minutes show that at the July meeting, the "vast majority" of policy makers "believed that relaxing policies at the next meeting may be appropriate if the data continues to match expectations.

The meeting minutes are prepared for Powell's speech on Friday, and although they won't tell us exactly what will happen at the September meeting, they will give us a framework, "said Rob Haworth, senior investment strategist at Bank of America Wealth Management in Seattle. Another thing that the market will focus on in Powell's speech is the balance between inflation and the labor market

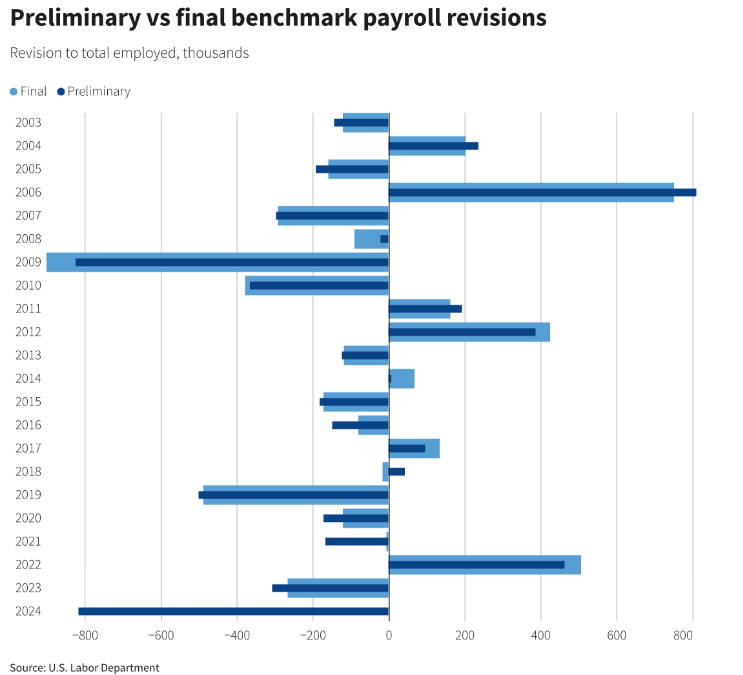

In terms of economic news, the US Department of Labor has released a preliminary revised baseline of employment data for the 12-month period ending in March 2024.

This revision has lowered the previously announced 2.9 million new job positions by 818000. This is the largest initial downward adjustment since the global financial crisis, indicating that the apparent weakness in the labor market may be more pronounced than previously anticipated.

The good news is that its direction is consistent with expectations, "Haworth added. This also supports the argument that the market has been building, that the labor market is weakening and the Federal Reserve will need to start cutting interest rates

(Preliminary benchmark salary revision chart source: Reuters)

Is the depreciation of the US dollar good or bad?

The US dollar continued to decline in August. In 2022, after a decade of sustained growth, the US dollar reached its highest level since the beginning of the 21st century.

I actually don't like the word 'power' because it has a positive connotation, "said Matthew C. Klein, co-author of" Trade War is Class War "and founder of global economic subscription research service The Oversoot. What we really want to say is that prices are now more expensive than before. So the US dollar can buy more foreign goods than before, and if you want to buy these things, it's obviously a good thing

The value of the US dollar depends on the economic conditions in the United States and around the world, so it is difficult to simply define a strong dollar as good or bad overall.

Harold James, a professor of history and international affairs at Princeton University, said, "When the US dollar strengthens, the political influence of the United States becomes greater; when the US dollar weakens, the political influence of the United States becomes smaller

The strengthening of the US dollar also has its drawbacks. If international consumers cannot afford American goods, the demand for American products from abroad may decrease. American workers may be negatively affected.

James said, "People who benefit from a strong dollar are usually different from those who benefit from a weak dollar

Due to this negative feedback loop, US presidents do not always want the US dollar to strengthen. For example, former President Donald Trump expressed concern about the impact of a strong US dollar on US exports before the COVID-19 epidemic was blocked. He attributed the appreciation of the US dollar to the monetary policy guidelines of the Federal Reserve.

At a press conference in February 2020, Trump said, "I believe we have been severely hurt by the Federal Reserve, which has created a very strong dollar. A strong dollar has its benefits, but it has also made it more difficult for us to do business outside of the United States

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights