Expectations of Federal Reserve interest rate cuts cooling down, gold prices hit their biggest weekly decline in three years, focus on Russia Ukraine situation

On Monday morning (November 18th) in the Asian market, spot gold rose slightly and is currently trading at $2572.56 per ounce. The tension between Russia and Ukraine has intensified over the weekend, and the market's risk aversion has increased, providing rebound momentum for gold prices. Gold prices slightly weakened last Friday, closing at $2561.52 per ounce, with a weekly decline of approximately 4.58%, marking the largest weekly decline in over three years. This was due to the cooling expectations of the Federal Reserve's interest rate cuts boosting the US dollar and weakening investors' interest in gold.

Despite a slight decline in the US dollar index last Friday, the US dollar still rose 1.64% last week, marking its largest weekly increase in over a month, making gold more expensive for holders of other currencies.

At the same time, the yield of US treasury bond bonds increased after data showed that retail sales growth of the world's largest economy exceeded expectations last month.

Data shows that retail sales in the United States increased by 0.4% in October, and the sales growth rate in September was revised up from 0.4% to 0.8%, while core retail sales decreased by 0.1%; Revised to a growth rate of 1.2% in September.

Alex Ebkarian, Chief Operating Officer of Allegiance Gold, said, "All uncertainty, especially short-term uncertainty, has been eliminated. Now gold has just returned to fundamentals.

Economists believe that President elect Trump's tariff plan will stimulate inflation and may slow down the Federal Reserve's loose interest rate cycle.

As gold is a non yielding asset, rising interest rates will reduce the attractiveness of holding gold. Federal Reserve Chairman Powell stated in his speech last Thursday that the Fed does not need to rush to cut interest rates.

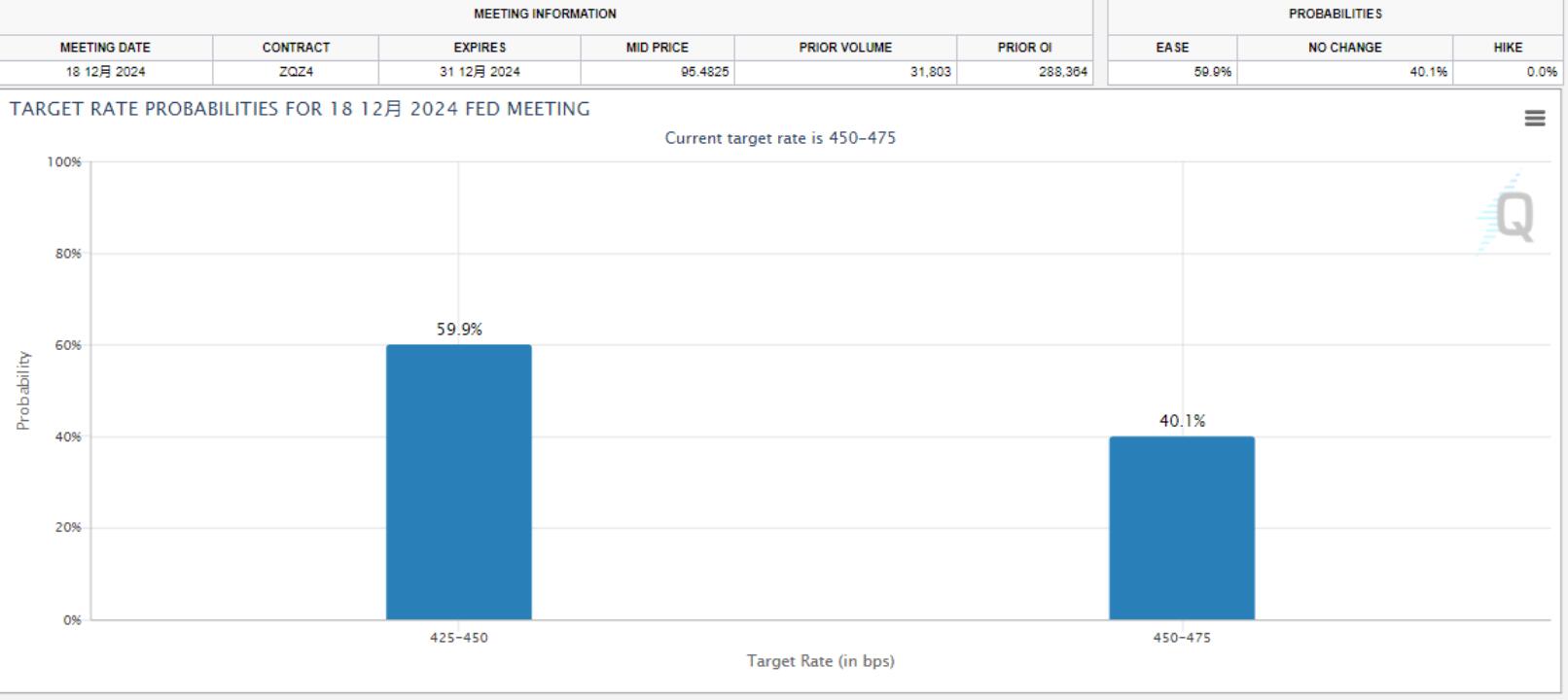

According to the CME Fedwatch tool, the market currently believes that the probability of a 25 basis point rate cut in December is 59.9%, lower than the previous week's 83%.

The survey shows that most institutions tend to be bearish on the future of gold, but most retail investors still tend to be bullish on the future of gold.

There are relatively few economic data lines this week. Pay attention to the data of the US real estate market, the PMI data of European and American countries in November, and the relevant news of geographical situation.

On November 17 local time, three insiders said that the Biden administration of the United States had lifted restrictions on Ukraine from using weapons provided by the United States to attack targets in Russia, which was a major change in the United States policy in the Russia-Ukraine conflict.

Russia has warned that if restrictions on the use of US weapons against Ukraine are relaxed, it will consider this move a "significant escalation".

According to sources, Ukraine plans to conduct its first long-range attack in the coming days, which is likely to use the Army Tactical Missile System (ATACMS).

According to Ukrainian officials cited by Reuters on the 17th, Russia launched its largest missile attack on Ukraine since August, with explosions in the capital Kiev and several other cities.

Ukrainian Foreign Minister Serbiga stated on Sunday that Russia's attack on Ukraine was one of the largest airstrikes in recent times, targeting the country's energy infrastructure.

From a technical perspective, the daily level continues to focus on the support of the 100 day moving average, which is currently around 2545.31. If the gold price can hold this position, it is necessary to guard against the possibility of the gold price regaining its upward trend; If it falls below the 100 day moving average, it may further decline towards the 2500 level.

The retail sales growth in the United States in October exceeded expectations, and the strong economy has raised doubts in the market about the December interest rate cut

The retail sales growth in the United States in October was slightly higher than expected, as households increased their purchases of cars and electronic products, indicating strong economic momentum in the fourth quarter.

Last Friday's sales report was quite optimistic, and the September data was significantly revised upwards. Coupled with the news of a rebound in import prices last month, traders lowered their expectations for the Federal Reserve to cut interest rates in December. Federal Reserve Chairman Powell said on Thursday, "The economy has not sent any signals that we need to urgently cut interest rates

The retail sales data has made many market participants doubt whether it is necessary to cut interest rates again at the December meeting, "said Christopher Rupkey, Chief Economist of FWDBONDS." As fiscal policy is expected to enter the fast lane of stimulating economic growth, the Federal Reserve's monetary policy may not add another fuel to promoting growth through interest rate cuts, as this could lead to a resurgence of inflation.

The US Bureau of Statistics stated that retail sales increased by 0.4% last month, and were revised upwards to 0.8% in September. Economists surveyed by Reuters previously predicted that retail sales (mainly goods, not adjusted for inflation) would increase by 0.3%, compared to the previously reported 0.4% growth in September.

Economists predict that retailers will achieve quite good performance in the holiday shopping season starting later this month.

Retail sales, excluding automobiles, gasoline, building materials, and food services, decreased by 0.1% last month, and the September data was significantly revised up to a growth of 1.2%. This so-called core retail sales is closest to the consumer spending portion of GDP, with previous reports indicating a 0.7% increase in core retail sales in September.

Hurricanes and strikes by Boeing factory workers have suppressed industrial production in September and October, and it is expected that economic growth in the fourth quarter will temporarily slow down to around 2.5%. The economic growth rate for the third quarter was 2.8%.

Another report from the US Bureau of Labor Statistics shows that import prices rebounded by 0.3% in October, compared to a 0.4% decline in September without correction. Economists previously predicted that import prices without tariffs would decrease by 0.1%. The import price in October increased by 0.8% year-on-year, while the import price in September decreased by 0.1% year-on-year.

The import price data consolidates economists' expectations for a 0.3% month on month increase in the core personal consumption expenditure price index (PCE) in October, which will be on par with the growth rate in September, and the year-on-year growth rate will rise from 2.7% in September to 2.8%. The Core PCE Price Index is one of the monetary policy measures tracked by the Federal Reserve.

Morgan Stanley economist Michael Hanson said, "Although we expect overall consumer price inflation to continue to broadly cool down next year, the outlook for commodity prices is particularly likely to be affected by the potential offsetting effects of the new government's trade policies and further appreciation of the US dollar

The Federal Reserve discusses the pace and magnitude of interest rate cuts in response to strong data, with controversy surrounding the neutral rate

Strong US economic and inflation data continued to reshape the debate among Federal Reserve decision-makers on the pace and magnitude of interest rate cuts last Friday, with investors further lowering their expectations for the Fed's rate cut at its December meeting.

In the latest round of comments on US monetary policy, Federal Reserve officials continue to express confidence that inflation is being controlled and will allow the Fed to lower its benchmark interest rate from the current range of 4.5% to 4.75% (which is believed to suppress spending and investment) to a more neutral range for a period of time.

However, there is still controversy over how quickly this situation occurs and what level represents "neutrality". Federal Reserve Chairman Powell said last Thursday that the sustained strength of the economy means the Fed can slowly discuss.

A month ago, the market's expectation of a rapid interest rate cut next year was still fermenting, but there are signs that people are becoming increasingly hesitant about cutting interest rates. After Trump won the presidential election last week, a major political change is taking place as Wall Street attempts to reluctantly accept its expectations of further inflationary pressures in the coming year, as the incoming Republican president will push for tax cuts, higher tariffs, and a crackdown on immigration.

So far, Federal Reserve officials have been reluctant to indicate that they are considering this, but investors are already considering it, and market bets on the speed and magnitude of the Fed's rate cuts have decreased over the past week.

Boston Fed President Collins said last Friday that she believes there is little urgency for a rate cut, but does not rule out the possibility of the Fed cutting rates again at its next meeting on December 17-18.

Although several Federal Reserve decision-makers seem to be adopting a wait-and-see attitude towards another rate cut in December, they also stated that not cutting rates at a meeting would mean they would slow down the pace of rate cuts rather than completely stopping them.

Richmond Federal Reserve Bank President Barkin said he likes Dallas Fed President Logan's earlier statement that the captain should "slow down the ship as it approaches the dock.

Chicago Fed President Goolsby admitted in an interview with CNBC that an important indicator - the Personal Consumption Expenditures (PCE) price index excluding food and energy costs - is still "too high," estimated at 2.8% in October.

US Treasury yields slightly rise, strong data raises the possibility of suspending interest rate cuts

The yield of US treasury bond bonds rose slightly last Friday. As the data showed that the retail sales growth of the world's largest economy exceeded expectations last month, and the import price rose, the yield once hit a high for several months.

These reports increase the possibility of the Federal Reserve suspending interest rate cuts at next month's policy meeting.

The 10-year benchmark yield rose 1 basis point to 4.429% last Friday. After the release of strong economic data, the yield hit a new high of 4.505% in five and a half months during trading. Last week, the 10-year yield increased by 12 basis points.

The US two-year yield, which reflects interest rate expectations, rose slightly last Friday to 4.305%, and rose to 4.379% during trading, the strongest level since the end of July. This week, the yield increased by 4.9 basis points.

The highlight of retail sales data is not the results for October, but a significant upward revision for September, now showing a huge increase of 0.8% (month on month), "Dave Rosenberg, founder and CEO of Rosenberg Research, wrote in a report

According to LSEG's calculations, the probability of a 25 basis point rate cut in US interest rate futures at next month's policy meeting has decreased to 59.9%, compared to 63.2% late last Thursday.

On the other hand, the probability of suspending interest rate cuts has increased from 37% on the previous trading day to 40.1%. For 2025, the implied interest rate cut in futures will decrease from 47 basis points on the previous trading day to 44 basis points.

However, Pramod Atluri, chief investment officer of US bond funds under Capital Group, said: "The Federal Reserve may cut interest rates several times before the end of this cycle."

The US dollar has seen its largest weekly increase in over a month, as traders reassess their expectations for a rate cut

The US dollar fell slightly by 0.18% last Friday, but still recorded its largest weekly increase in over a month on the weekly chart. The market re evaluated its expectations for future interest rate cuts and believed that President elect Trump's policies may trigger inflation.

The market expects that the policies of the Trump administration, including tariffs and tax cuts, may stimulate inflation, thereby reducing the room for the Federal Reserve to cut interest rates and benefiting the US dollar.

Federal Reserve Chairman Powell stated last Thursday that the Fed does not need to hastily cut interest rates, prompting traders to abandon more aggressive bets on rate cuts next month and beyond.

The Federal Reserve is the main focus today, and I was somewhat surprised by the strengthening of the euro in the face of Powell's perceived hawkish rhetoric, "said Thierry Albert Wizman, global forex and interest rate strategist at Macquarie in New York." People may think that given some issues with the appointment of these (US cabinet) candidates, there will be more chaos next year. Therefore, I can understand why people have generally lost some confidence in Trump's trade and the theme of US exceptionalism“

The US dollar index closed down 0.19% on Friday, but hit a more than one-year high of 107.07 on Thursday, with a weekly increase of 1.65%, marking its best weekly performance since September.

Market research: Most institutions are bearish on the future market, while most individual investors remain bullish

In the latest market survey, a total of 12 analysts participated, with only 3 (25%) expecting gold prices to rise next week, 6 (50%) predicting a further decline, and the remaining 3 (25%) expecting gold prices to continue to consolidate but with a downward trend. A total of 181 retail investors participated in the online survey, of which 78 (43%) were bullish, 71 (39%) were bearish, and the remaining 32 (18%) expected gold prices to consolidate sideways.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights