The market is speculating on the extent of interest rate cuts by the European Central Bank and the Bank of England in 2025

The statements of ECB officials have to some extent weakened people's expectations of increasingly loose policies. The possibility of a 50 basis point interest rate cut in December is still under discussion, but Friday's PMI data will be crucial. Like the United States, people believe that the market's attitude towards the Bank of England's interest rate cut has become too tough.

The expectation of the European Central Bank's interest rate cut in 2025 is constantly changing

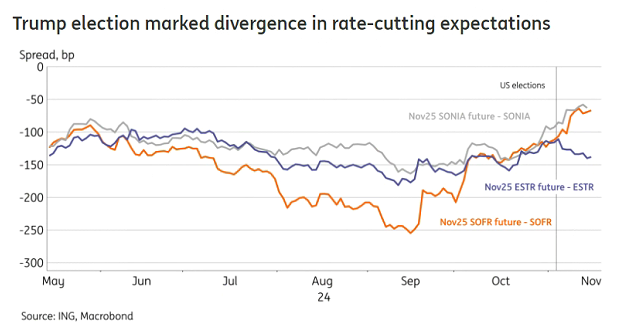

The market believes that the next interest rate cut by the European Central Bank will be in December, and it is expected that the rate cut will exceed 125 basis points by November next year, which is in sharp contrast to the more hawkish sentiment in the United States and the United Kingdom. Since Trump won the election two weeks ago, this divergence has clearly intensified, and there has been almost no data available for reference since then. If the gap continues to widen, people will not be surprised. That being said, there was some pullback in the market on Monday, with the European Central Bank's landing zone lowered by about 8 basis points, while the expectations of the Federal Reserve and the Bank of England remained almost unchanged.

The possibility of a 50 basis point interest rate cut in December is still under discussion, and Friday's PMI report may be the missing piece in the puzzle that made it happen. On Monday, three officials from the European Central Bank expressed concerns about the potential economic growth caused by trade tensions, which could also play a role in the ECB's decision to cut interest rates. However, the market seems unwilling to change based on speculation about Trump's presidency, so macro data will currently become a more important driving factor for front-end interest rates.

People believe that the market's attitude towards the Bank of England's interest rate cuts has become too tough

Image: Trump's election marks divergence in expectations of interest rate cuts

The most noteworthy line in the above chart is actually the expected landing point for the UK pound overnight rate SONIA. The budget announced by the UK on October 30th may have played a role in hawkish sentiment, but even after the US election, expectations of a rate cut by the Bank of England have significantly decreased. The rise in the short-term interest rate of sterling is also the main reason for the rise in the yield of 10-year British treasury bond bonds. People believe that this should return to levels below USTs and reach 4% by mid-2025, significantly lower than the current 4.5%.

Overall, the front end of the pound swap curve appears particularly elongated and is expected to readjust downwards. But since there are hardly any catalysts that can convince the market of this volatility in the short term, it may take until 2025 to see this volatility become a reality. Especially in terms of data, a series of better service sector inflation data are needed to convince the market that the Bank of England has the ability to further cut interest rates, rather than the current market expectation of two to three cuts.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights