Gold, oscillating annual closing line!

In terms of gold, on Friday, it ultimately lost to Time - the European market.

In a special oscillation range, time is large, and if key time points cannot be broken, it is easy to suppress.

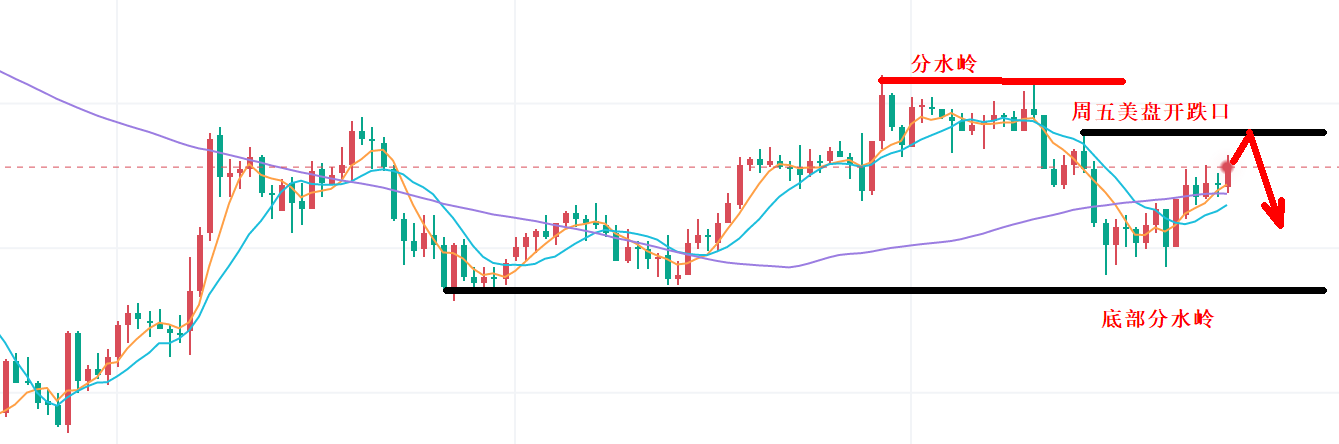

Looking at the technical points we emphasized on Friday:

Due to the strong bullish trend on Thursday, the market continued to rise strongly, but encountered resistance at the critical position of 2638. Whether it can be strong depends on whether it can break through the European market timing.

2. At the time of the European session, the double peak was suppressed, and the rebound correction broke through the early morning rising point 5-8 points before the US session.

3. If this kind of watershed is broken and rebounds before the US market, then the US market is bound to be a second short selling, and the intraday high of the watershed is at the defensive level of 2638. The US market also continued to decline.

4. This is the suppression of key time points in the European market.

However, the continuity of the decline is not good. From early morning to early morning, the price continued to return to the vicinity of the Friday opening, with 2629 being 2618

The 2618 position is usually a point that can be missed during oscillation and cannot be missed. Should it be executed today?

1. The weekly rhythm, a small cross, can be considered as ignoring K, but the correction during the upward trend is also a form of correction. Therefore, this type of sideways trend is not stagflation, but rather easy to form bullish support, providing a driving force for the later upward trend.

2. As for the daily trend, after the price retraces to the 100 day moving average, the recent trend has been fluctuating back and forth around the 100 day moving average. According to the rhythm, breaking below the 100 day moving average is a buying point, and the short-term rhythm is also within the range. The trend is still brewing, so there is no single side buying in the middle line yet.

3. In the short term, it is a bullish trend with consecutive positive and single negative movements. The European market remains crucial.

There are two points: price: 2618 level and Friday's opening of a decline in the US market, 2629-2631. Time point: European market.

Price watershed 2638

The rhythm of morning rise, the watershed morning low of 2619. However, this is also a continuation of Friday's bottoming out and rebound, so this watershed at 2610 is not 19. As long as it breaks the level, it is oscillating.

During the oscillation, the double tops and 2618 are not missed positions.

So, today's key point is still 2630-31. At the European market, the watershed is 2639

In the short term, it rises in the morning and touches short in the afternoon, with a focus on the European market.

The European market continues to rise, forming momentum, while the US market retreated from the short position and bought more twice, looking for a breakthrough.

If suppressed, the European market will definitely break the 2619 level and form a volatile trend.

The current situation is that both long and short positions in key positions are acceptable, not a trend trend. At the same time, do not be greedy for the target and fluctuate in stages of 8-10 US dollars.

Short term planning for the annual closing line and starting to lay out opportunities for the mid year 2025.

The above views are for reference only. Investment carries risks, and caution should be exercised when entering the market

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights