Battle for Key Points in the US Index, EURUSD Wants to Break through Daily Resistance, Raising Expectations

Recently, the treasury bond bond market has fluctuated violently, with the yield of 10-year treasury bond bonds reaching the highest level since May, and that of 30-year treasury bond hitting the highest level in 14 months. On Monday, the Ministry of Finance auctioned three-year treasury bond, with weak demand. At the same time, Trump's tariff plan report triggered market fluctuations, which, although it was subsequently denied, has affected the yield of treasury bond. In terms of economic data, new orders for US goods in November decreased due to weak demand for airplanes, and equipment spending by businesses slowed down in the fourth quarter. This Friday's employment report has received a lot of attention, and there is a discrepancy between Citigroup's and The Wall Street Journal's predictions. Citigroup expects the unemployment rate to rise, which may change the market's expectation of the Federal Reserve cutting interest rates. The decline of the US dollar index narrowed after falling from a high on Monday, and Federal Reserve Governor Cook said he is cautious about interest rate cuts. In addition, there are many important data to be released this week, such as the ADP employment report and the minutes of the Federal Reserve's December monetary policy meeting. Overall, there is a lot of uncertainty in the US economy and financial markets, and market participants are closely monitoring various data and policy developments to make rational investment decisions.

US dollar index

In terms of the US dollar index, the overall price of the US dollar index showed a downward trend on Monday. The highest price of the day rose to 109.043, the lowest was 107.721, and closed at 108.212. Looking back at the performance of the US dollar index on Monday, after the morning opening, the price fluctuated and corrected, and then came under pressure again. As gold and foreign exchange analyst Yan Ruixiang said, the price broke through the four hour support as scheduled, and the resistance level of the four hour support has always emphasized the key to the short term. After breaking through the four hour support yesterday, it fell sharply and tested the daily support position as scheduled. At present, the focus is on the resistance in the 108.60-70 range above and the 108.17 position on the daily line below. If the price continues to break through the daily line support, the subsequent attention should be paid to the lower edge of the previous upward trend line and the low point position of 107.55 before the high point. This position determines whether the US index will continue to be strong or under pressure.

Short selling in the 108.60-70 range of the US Composite Index, defending against $5, with a target of 107.50

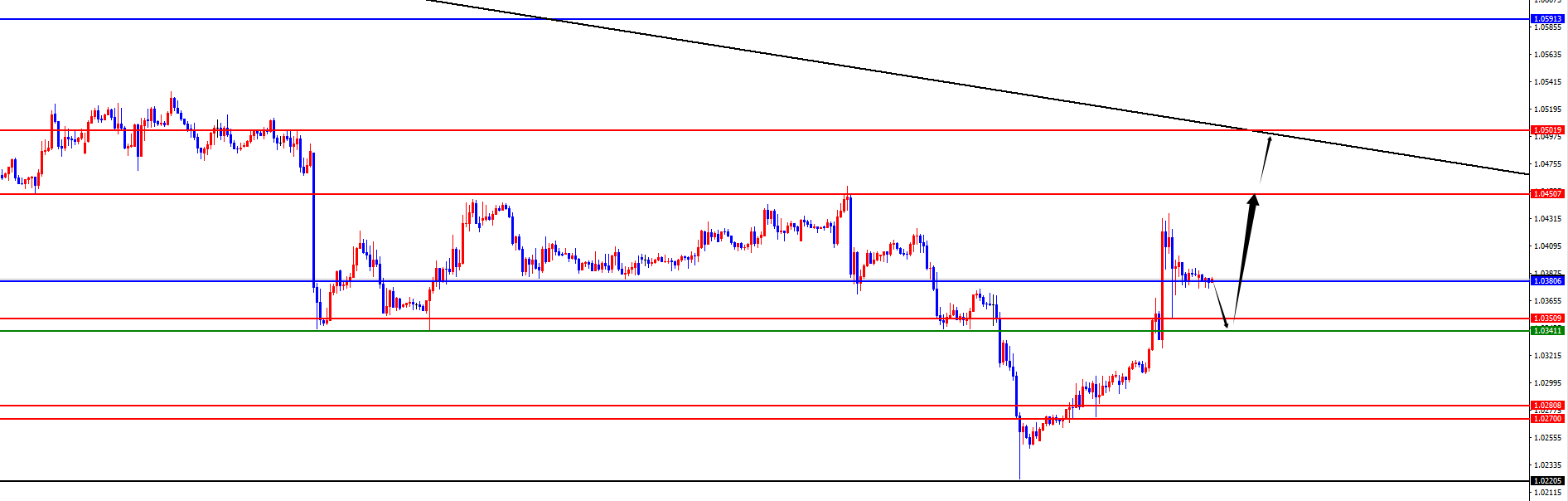

EUR/USD

In terms of EURUSD, the overall price of EURUSD showed a significant increase on Monday. The lowest price of the day fell to 1.0294, the highest rose to 1.0436, and closed at 1.0389. Looking back at the EURUSD market performance on Monday, the price fluctuated briefly during the morning session and then rose directly. As the author mentioned, the price soared all the way up and tested into the daily resistance zone. Overall, EURUSD has further upward performance in the future. On the weekly chart, we need to pay attention to the resistance in the 1.0590 area temporarily. At the daily level, we need to pay attention to the 1.0380 area temporarily, while at the 4-hour level, we need to focus on the 1.0340-50 support range temporarily. We will continue to pay attention to the 4-hour support range to see an upward trend, and focus on the 1.0450-1.0500 area in the short term above. We also analyzed in advance that EURUSD hit a low point last Thursday. Overall, Europe and the United States are expected to experience a wave of upward trend. If it continues to break through the weekly resistance, it will open up a medium-term upward trend. Everyone must pay attention to the market rhythm transition.

Buy long in the EURUSD 1.0340-50 range, defend 40 points, target 1.0450-1.0500

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights