Bank of England decision speculation: expected to cut interest rates by 25 basis points, may imply more interest rate cuts in the future

At 20:00 on Thursday (February 6), the Bank of England will announce its interest rate resolution. The Bank is expected to cut interest rates by 25 basis points, which will be the third rate cut since the beginning of the COVID-19 epidemic in 2020. The Bank needs to help the weak economy cope with the still strong inflation pressure.

Due to concerns about UK Chancellor of the Exchequer Rachel Reeves raising taxes on employers, the risk of a global trade war caused by US President Trump, and rising costs, the UK economy has hardly grown since mid-2024.

But price pressures remain high, which limits Bank of England Governor Andrew Bailey and his colleagues from expressing their views on plans for 2025 on Thursday.

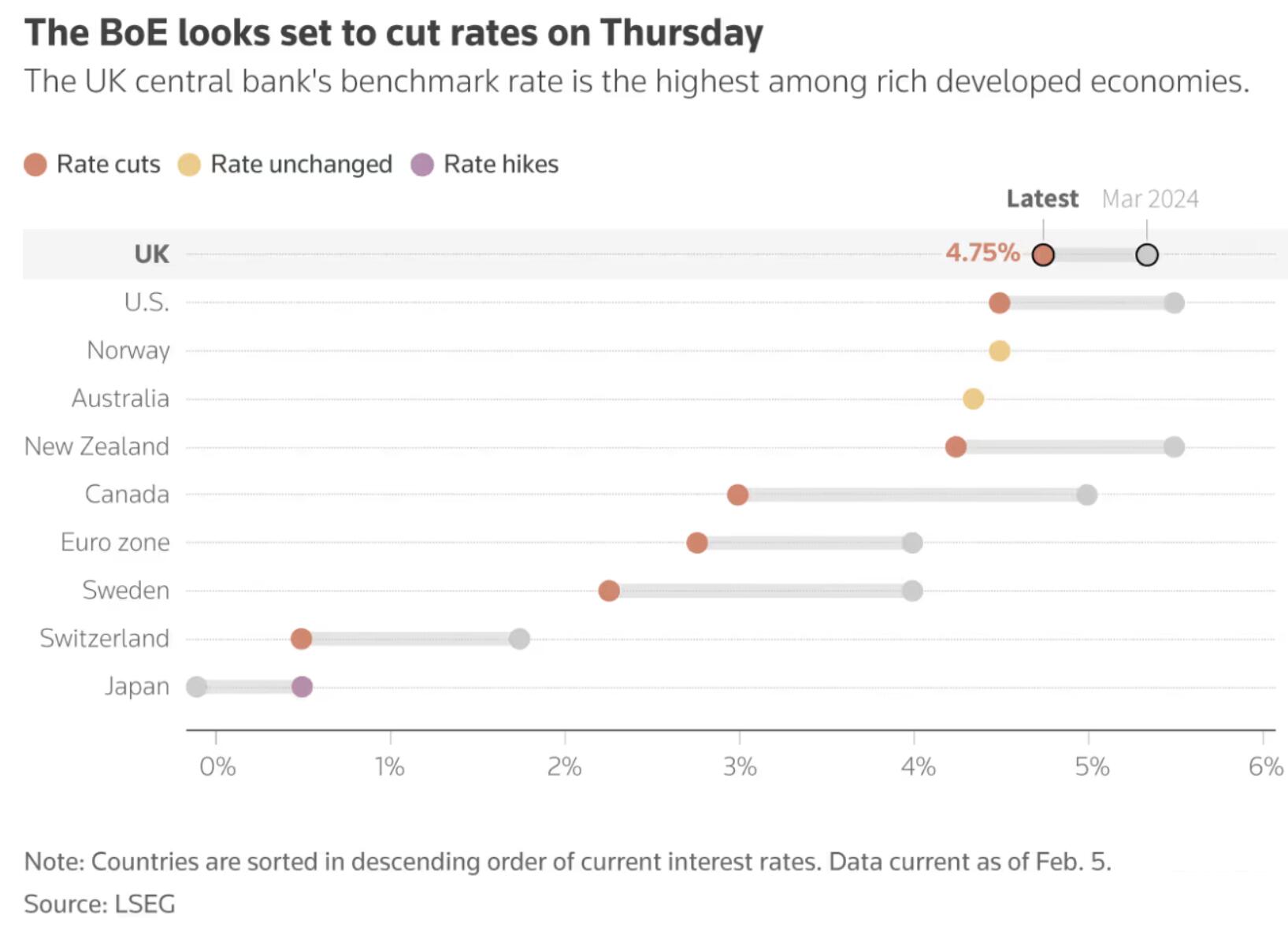

UK interest rates are the highest among large developed economies

The Bank of England's benchmark interest rate is currently 4.75%, the highest among large developed economies. It is widely expected that the central bank will cut interest rates by 25 basis points on Thursday, reaching the same level as Norway and approaching the Federal Reserve's interest rate range of 4.25-4.5%.

Matt Swannell, Chief Economic Advisor of EY ITEM Club, a forecasting agency, stated that there are increasing signs of economic stagnation in the UK, which could put more pressure on decision-makers at the Bank of England.

Swannell said, "This does not eliminate the long-term difficulties faced by the Bank of England. Its latest forecast may indicate that economic growth will weaken compared to three months ago, but inflation rates will be higher in the near future

The Bank of England will release its latest economic forecast and interest rate decision at 20:00 Beijing time, and Bailey and other senior officials will hold a press conference half an hour later.

Investors expect at least three 25 basis point interest rate cuts by the end of 2025. Last month's Reuters survey showed that most economists expect the Bank of England to cut interest rates four times this year.

The Bank of England may release signals of accelerating interest rate cuts

Analysts predict that the UK may prompt investors to anticipate that interest rate cuts will be faster than they currently predict in the event of economic stagnation.

Economists surveyed by Reuters unanimously predict that the Bank of England will lower its benchmark interest rate from 4.75% to 4.5% on Thursday, and will also update its economic growth and inflation forecasts at that time. Investors believe that the likelihood of a rate cut is close to 90%.

Since the Bank of England released its last forecast in November, the UK economy has stagnated, and the inflation indicator that interest rate setters are most closely monitoring has declined last month, despite unexpected acceleration in wage growth.

Due to these data sending mixed signals about the economic outlook, investors will closely monitor any changes in the views of members of the Monetary Policy Committee. In December last year, six committee members voted to keep interest rates unchanged, and three committee members voted to support a 25 basis point rate cut.

Interest rate setters may provide preliminary guidance on a key issue regarding the inflation outlook: how employers will respond to the government's budget proposal on October 30th. The budget will significantly increase the payroll tax starting from April.

However, the Bank of England is also concerned about price pressure. The survey shows that consumers have raised their expectations for inflation, and businesses also plan to increase prices in the coming year. Wage growth unexpectedly accelerated at the end of 2024.

Citigroup's economists pointed out in a report to clients that "the monetary policy committee's interest rate cut cycle is entering a more difficult stage. The reversal of energy prices and the significant rise in labor costs indicate that inflation will rebound - we believe the inflation rate in April will reach 3.5%. This is happening amid a deteriorating labor market

Driven by changes in US interest rate expectations and concerns about UK public finances ahead of President Trump's inauguration, the sell-off of UK government bonds has forced Chancellor of the Exchequer Rachel Reeves to say she will take action to comply with her fiscal rules if necessary.

She may hope that the Bank of England will turn dovish. The increase in government borrowing costs since the budget was announced may cause her to deviate from the fiscal rules, and may require tax increases or spending cuts to get her back on track.

The market's expectation for the Bank of England to cut interest rates may be too gradual and not in line with the expectations of the Monetary Policy Committee. Some members may emphasize the risks brought by economic weakness and deteriorating prospects for the eurozone.

Since mid-2024, the European Central Bank has cut interest rates five times, while the Bank of England has only cut interest rates twice.

Jane Foley, senior foreign exchange strategist at Rabobank, said, "Although the dovish statement from the Bank of England may put the pound at a disadvantage in the short term, it will also bring comfort to investors and the business community

Since the beginning of this year, there have been few public comments from members of the Monetary Policy Committee. Those who have expressed their opinions tend to emphasize the possibility of interest rate cuts.

On January 15th, in his first speech after joining the Monetary Policy Committee, external member Alan Taylor stated that it was time to cut interest rates, and he expected there would be four cuts in 2025.

The Bank of England may face more interest rate cuts in the future

Sarah Breeden, Deputy Governor of the Bank of England, stated on January 9th that economic data supports the Bank of England's signal of gradual interest rate cuts, but it is difficult to determine the specific timing.

Although short-term market interest rates have decreased in the past few weeks, the two-year and three-year market interest rates remain significantly higher compared to the rates supporting the Bank of England's November forecast.

This means that members of the Monetary Policy Committee may judge that financial conditions affecting corporate and mortgage interest rates are too tight and will further push inflation below target levels in the coming years.

Philip Shaw, Chief Economist of Investec, stated that weak economic growth means it will be more difficult for businesses to pass on the cost of tax increases to consumers.

Shaw said, "This should make it easier for the Bank of England to ignore the recent rise in inflation and take more interest rate cuts than currently expected.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights