Spot gold's 10 day line breaks, the balance gradually shifts towards bears!

The battle between long and short positions in gold is still ongoing. After three consecutive crosses last week, the gold rose sharply and closed at a bullish candlestick on Monday. On Tuesday, the gold fell below the 10 day line and reached the support of the upward trend since 2614, and then experienced a bottoming out and rebound. The daily long line has a strong bearish shadow; Yesterday, the Asia Europe market surged and fell back, while the US market plunged again without breaking Tuesday's low point, ushering in a bottoming out and rebound. The daily chart closed at a bullish cross!

Fundamentally, continue to pay attention to Trump's tariff policies, Russia Ukraine peace talks, and the situation in the Middle East.

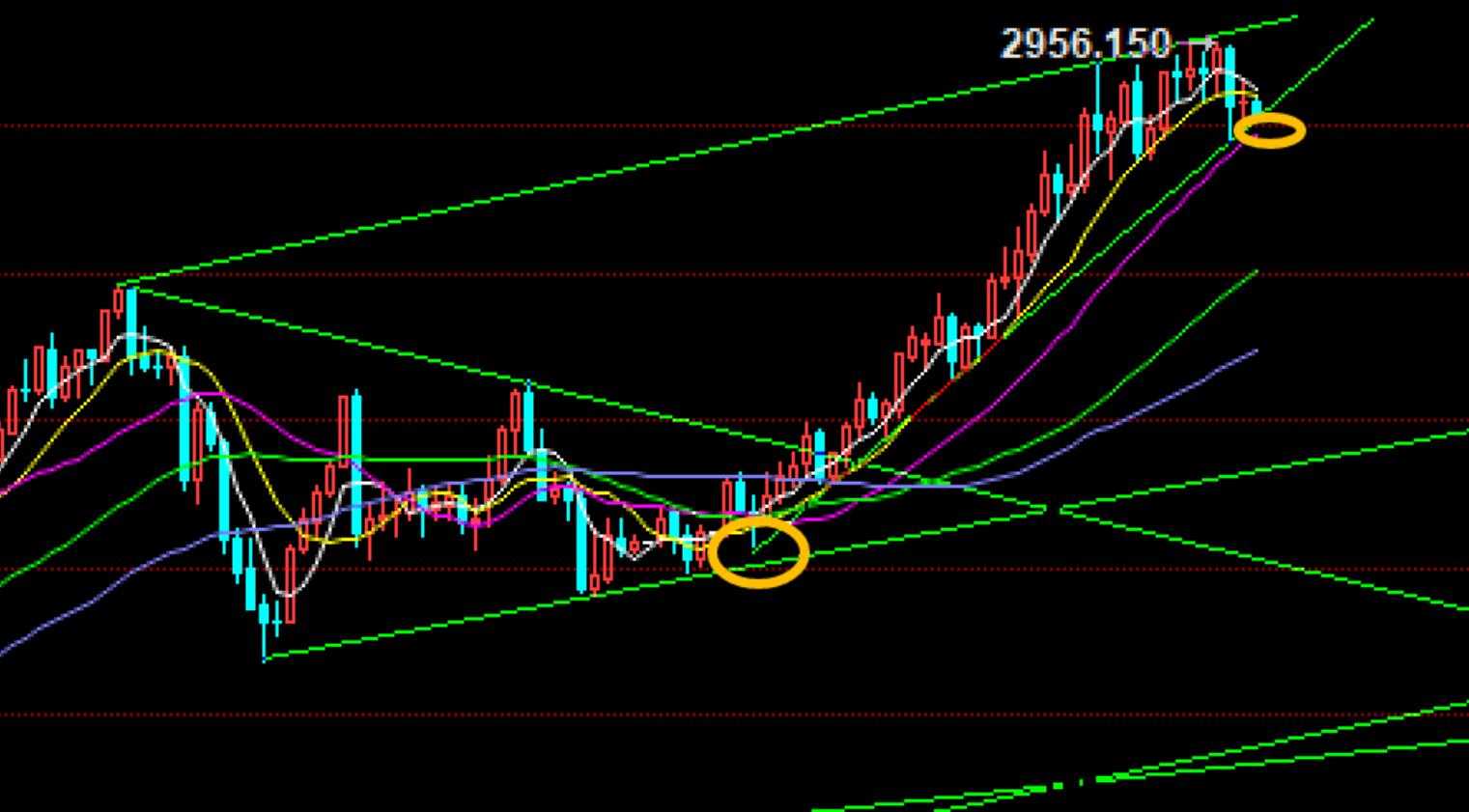

From the perspective of the gold daily line, it has successfully fallen below the 10 day line, and currently the 5 and 10 day lines have changed from support to pressure; However, the one-day bearish trend on the daily chart has not been broken since January 6th. From a 4-hour perspective, the 60 day moving average has fallen below for the first time, which is favorable for bears. Pulling up near the trend line multiple times during the day indicates a fierce long short game and a tug of war before breaking down.

Next, pay attention to the suppression of the 10 day and 5 day lines, as well as yesterday's high point of 2930 in the area. Below is a firm bearish sentiment. Pay attention to the breaking of the trend support line since 2614 below. Before breaking, bulls will still resist tenaciously. The upward trend of the US stock market on Tuesday and Wednesday already indicates the strength of the trend support; If the downward trend support is broken, the downward space will open up, and then pay attention to 2855-50 and 2835. Further 2810-2800 and breaking levels. However, it should be emphasized that the above positions are all key defensive positions for bulls, and touching these positions will inevitably bring about a severe rebound.

For the 5-day and 10 day lines above 2930, if they break upwards, the market will continue to rise. Pay attention to reaching a high of 2940-45 and a new high before falling again. In terms of operation, use the 5 and 10 day lines and 2930 to suppress short selling, target 2900 and daily trend support, and break through short positions for replenishment; Before breaking through, do not chase short to prevent another significant rebound. If it breaks through the 5 and 10 day lines and 2930. Wait for a surge of 2940-45 or a new high before emptying! If there are multiple orders, the support level depends on the situation to participate!

International silver follows gold. At present, the 5 and 10 day lines are under pressure, following the golden high and breaking through risk control.

US crude oil remains short below 70, and when it reaches a high level, the market strengthens above 70; Below 68-67.5.65.63 is the target position and also the support.

The US dollar index continues to see a rebound in the short term, relying on 106-106.2 to maintain the same rebound strategy; Pay attention to the breakthrough situation of 106.9 and 107.3 above!

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights