US tech giants' miserable ', US tariff war may trigger global' digital retaliation 'storm

According to Refinitiv, as Trump brandishes the stick of tariffs to relive historical grievances, the global market is brewing a precise retaliation against American tech giants. With the stock prices of the seven major American tech giants plummeting 25% from their December highs and entering a bear market, behind this seemingly sudden storm lies the inevitable logic of the restructuring of the global trade order - the United States' dominant position in technology and intellectual property is shifting from a competitive advantage to a strategic weakness.

The fatal backlash of historical scripts

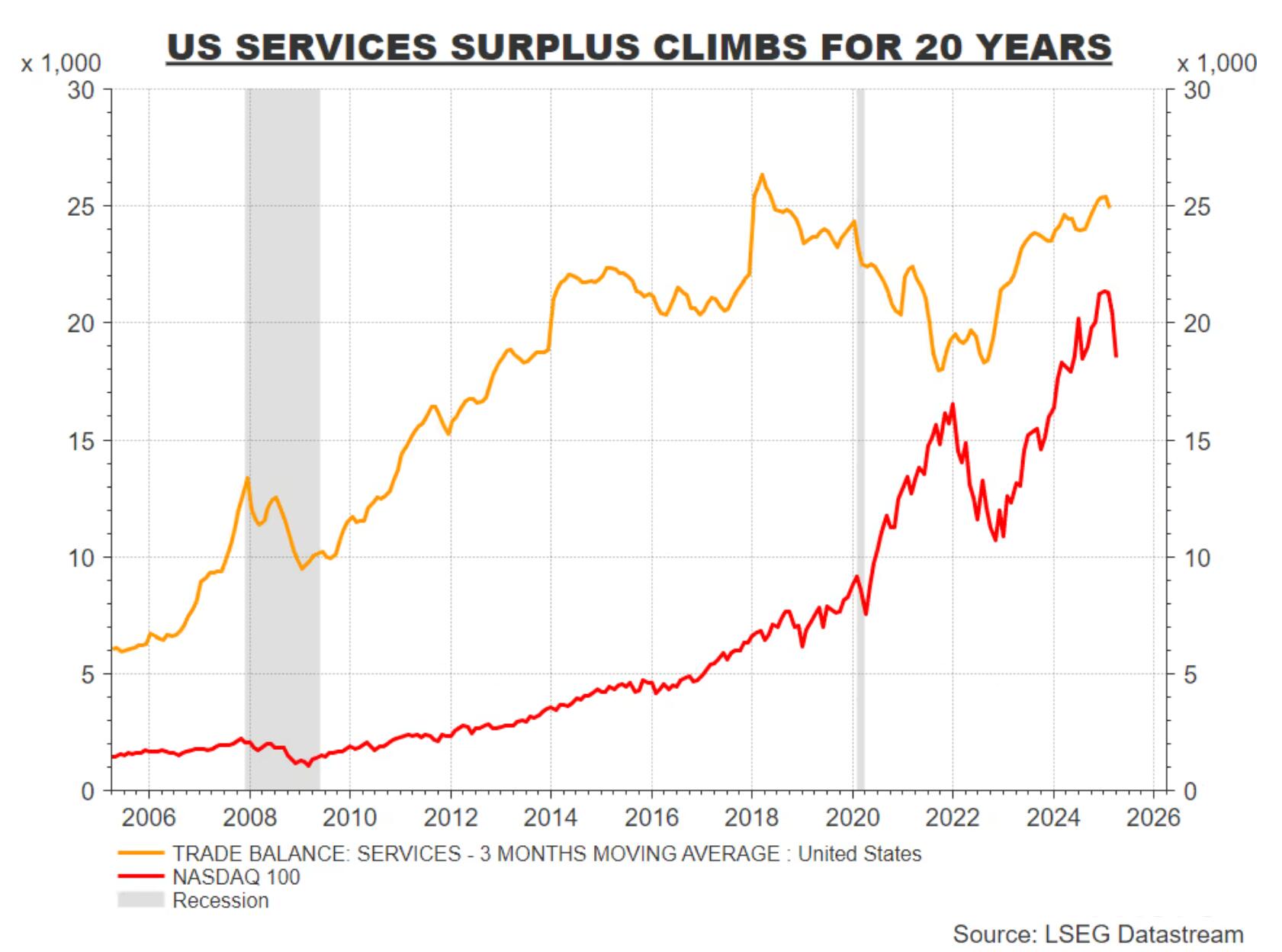

Trump uses the historical narrative of being "plundered" to justify century long high tariffs, but ignores that the current global trading system was designed by the United States itself - the "devil's trade" of intellectual property protection for commodity market access in the 1994 Uruguay Round, which now creates a dangerous balance between a $1.2 trillion goods deficit and a $1 trillion services surplus. Harvard economist Ricardo Hausmann warns that the global mechanism for protecting American intellectual property may collapse.

Figure: The US trade surplus in services has been increasing for 20 consecutive years

The European Sword of Digital Taxation

France has ordered companies to suspend investment in the United States, and the EU's "anti coercion tools" are even more insidious: from public procurement blockades to financial service access restrictions, and even revocation of intellectual property protection. German Economy Minister Habermann's statement was particularly sharp: 'Trump must feel the real pressure from Europe'. These measures that go beyond tariffs are aimed directly at the doorstep of American technology companies.

Cruel correction of valuation foam

The market's long bets on technology stocks were once the most crowded trading in the world, but suffered epic liquidation after the announcement of tariffs. On the surface, it may seem like an economic recession concern, but in reality, investors suddenly realize that when $16.4 trillion in overseas investment and $374 billion in profits from foreign companies become targets of retaliation, the global profit model of tech giants is facing systemic risks.

The invisible battlefield of service trade

Trump's "tactical mistake" in focusing on commodity trade is becoming apparent - the US hegemony in digital, telecommunications, financial and other service sectors has become a more vulnerable "Achilles heel". As Asian powers fired the first shot of retaliation last Friday, "digital tariffs" targeting Apple's App Store commission, cloud computing service licenses, cross-border data flows, and more may follow one after another.

【 Summary 】

The ongoing tech giant hunt is essentially the inevitable result of the breakdown of the global contract. When the United States tears up its commitment to market access for goods, the loyalty of countries to intellectual property protection naturally collapses. The "far beyond tariff response measures" mentioned by French Finance Minister Lombard may indicate that the global trade war is entering a more brutal new stage - here, algorithm patents are more deadly than steel tariffs, data sovereignty is more important than trade surplus, and Silicon Valley's technology empire is standing on the edge of a cliff.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights