The gold adjustment has ended and started to rise, staying bullish above 3300 during the trading session!

The current geopolitical risks have not been eliminated, and the situation in the Middle East has become a long-term historical issue. Iran and Israel still have the potential to escalate conflicts and prolong the Russia Ukraine war, which is still one of the key factors that the market is concerned about. The unresolved events will still lead to an increase in long-term safe haven demand. In addition, global central banks continue to increase their holdings of gold, with the People's Bank of China increasing its holdings for 18 consecutive months, and the diversified reserve demand in emerging markets supporting long-term gold prices.

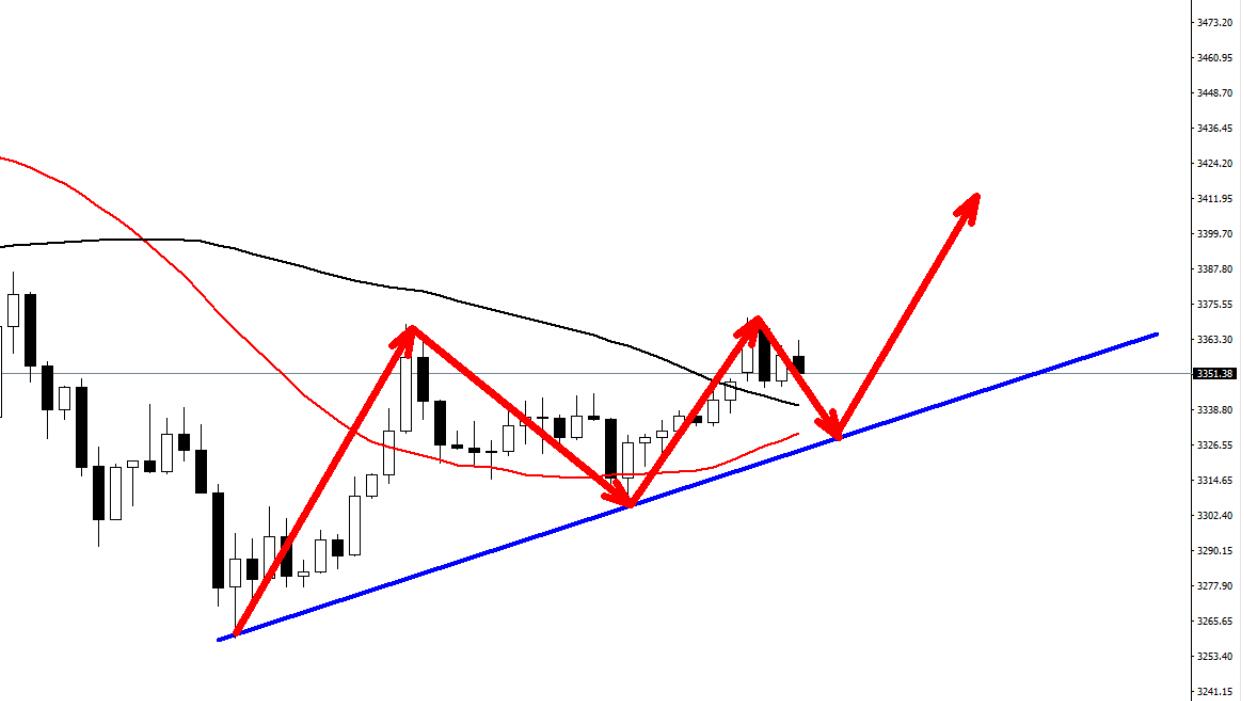

For the current market, after the previous round of sharp decline, the market has begun to stabilize and return to positive, and bulls have started to exert force. The market still approaches it with a bullish mindset, focusing on the previous low point of 3306 in the morning to buy on the first line, while the main focus is on the breakthrough of the resistance level of $3370 above. If it breaks through and stabilizes, it will open up new upward space; If it falls below $3300, be alert to the sudden drop caused by programmatic selling!

Specific strategies

Gold over 3310, stop loss 3295. Target 3350

Disclaimer: The above suggestions are for reference only. Investment carries risks, and caution should be exercised when operating

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights