Gold is poised for action, maintaining a bullish outlook for the day!

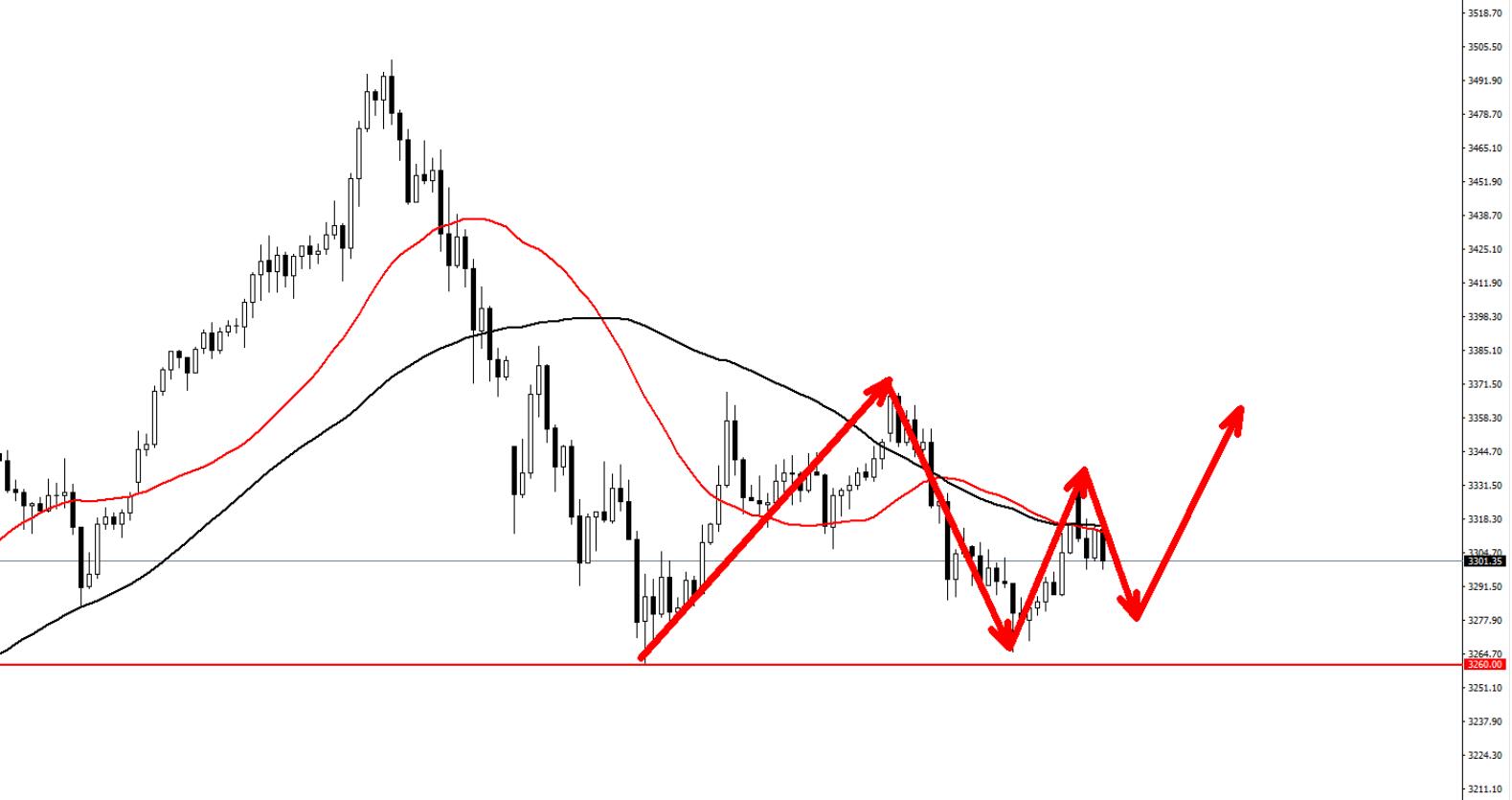

Gold opened higher but then retreated in the morning session. In terms of market sentiment, investors had mixed emotions. Some investors had an urge to take profits, leading to a pullback from the high opening price of gold. However, long-term investors continued to favor gold's safe-haven and hedge function due to heightened geopolitical risks globally and uncertainties in the economic outlook. Overall, gold ETFs also showed inflows of funds, providing some support to gold prices. After the morning's high opening and subsequent retreat, gold did not continue to decline and remained above the support level of 3260!

There was intense competition between bulls and bears in the morning gold session, but the long-term outlook remained bullish. The intraday strategy aligned with the overall trend, with a focus on the support level of 3260. As long as gold remained above 3260, we maintained our bullish stance. We waited for gold prices to slightly retrace to near 3275 during the session to enter long positions in batches!

Specific Strategy:

Buy gold at 3275, with a stop loss at 3260. Target price is 3330.

Disclaimer: The above suggestions are for reference only. Investment carries risks, and caution should be exercised when trading.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights