The euro soared by 10%! European businesses suffered a "double blow"

European businesses are facing an unprecedented "double blow." Under the heavy pressure of high US tariffs, the euro exchange rate has unexpectedly soared by nearly 10%, hitting a three-year high. This sudden exchange rate storm could shrink European businesses' profits by another 2-3%, casting an even darker shadow over the already fragile European economy.

Deadly Impact of the Soaring Euro

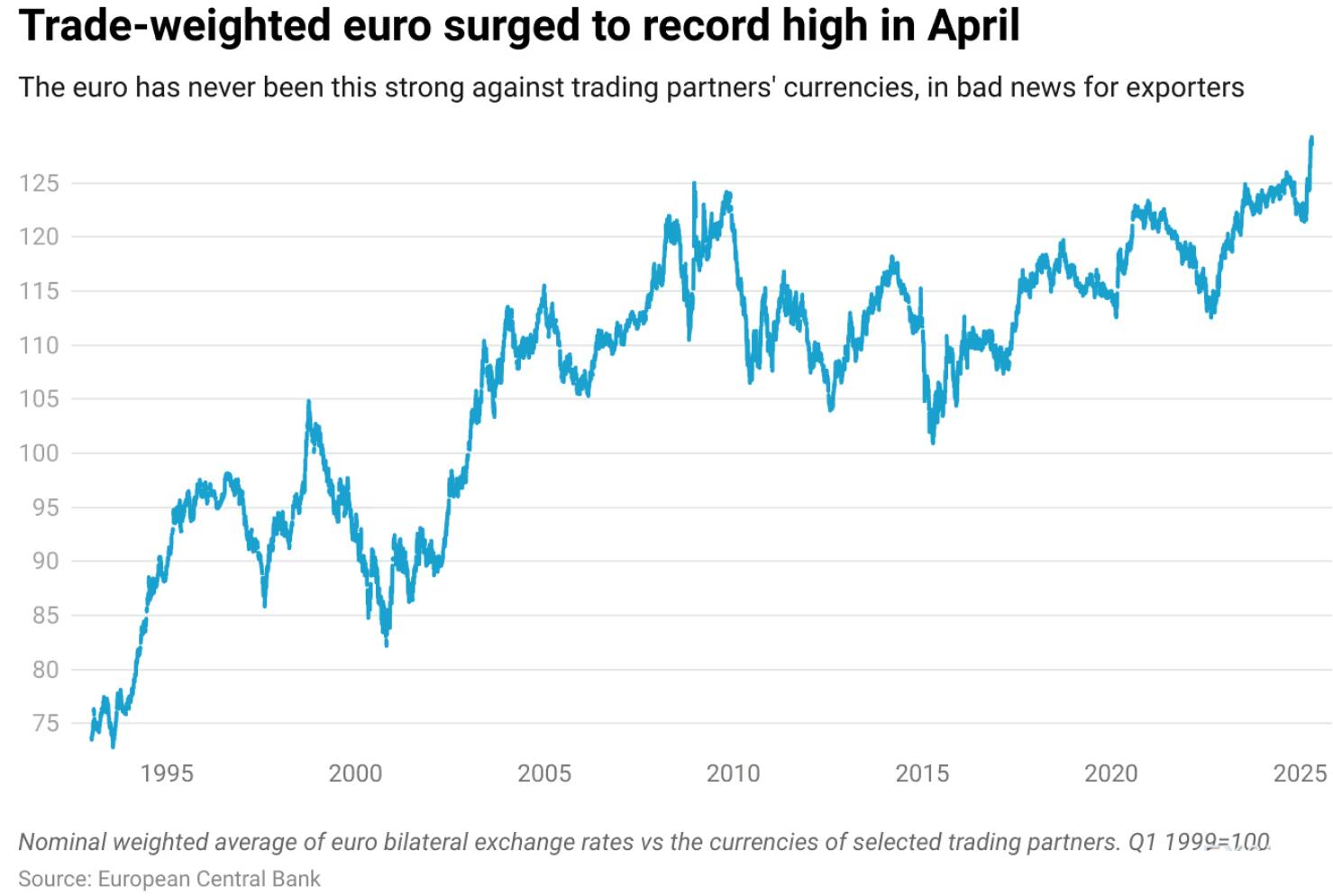

The recent trade-weighted exchange rate of the euro has hit an all-time high, with the monthly increase in April alone being the highest since the end of 2022. This surge has dealt a heavy blow to the European economy, which heavily relies on exports. According to Goldman Sachs data, 60% of the revenues of STOXX 600 index constituents come from overseas markets, with the US market accounting for nearly half. Emmanuel Cau, head of European equity strategy at Barclays, warns that a sustained 10% appreciation of the euro will directly reduce corporate earnings by 2-3%, which is akin to adding insult to injury in the context of tariffs already pressing down.

Image Caption: The trade-weighted exchange rate of the euro rose to record highs in April.

Automobile Manufacturing Bears the Brunt

In this exchange rate storm, Europe's automobile manufacturing industry has suffered the hardest hit. As Europe's most important export product, automotive stocks have plunged by 8% since Donald Trump took office, far exceeding the less than 1% decline of the STOXX 600 index. Last week, Jens Weidmann, president of the German Bundesbank, warned that Germany, the largest economy in the EU, could face a "mild recession" in 2025. The International Monetary Fund has also synchronously downgraded its growth forecasts for the EU as a whole for this year and next, casting a shadow over Europe's economic prospects.

Corporations Caught in Hedging Dilemma

Facing sharp fluctuations in exchange rates, European corporations find themselves in a dilemma. Technology giant SAP expects that for every 1-cent appreciation of the euro, its annual revenue will decrease by €30 million. Jackie Bowie, European director at Chatham Financial, a risk management firm, revealed that although corporate hedging activities have increased this year, there has been a recent trend of slowdown. Corporations are worried about missing out on better exchange rates while also fearing locking in unfavorable prices. What's more tricky is that sudden changes in tariff policies could render any hedging strategy completely ineffective. This dilemma is testing the survival wisdom of European corporations.

Summary

This perfect storm composed of "tariffs + exchange rates" is profoundly testing the adaptability of European corporations. As analysts predict that the euro could continue to climb to $1.20. the tough times for European exporters may only just be beginning. In this moment of uncertainty, corporations must not only deal with the immediate exchange rate shock but also prepare for a possible economic winter. This crisis could reshape the global competitiveness of European industries, and its far-reaching impact warrants continued attention.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights