Will OPEC+increase production ignite the oil market? How long can oil prices last?

On Monday (September 2nd), the global crude oil market continued last week's downward trend, with Brent crude oil and West Texas Intermediate (WTI) crude oil prices both falling. At 16:14 Beijing time, Brent crude oil fell 0.18% to $76.79 per barrel; WTI crude oil fell 0.26% to $73.36 per barrel. Last week, Brent crude oil fell by 0.3%, and WTI crude oil fell by 1.7%.

The main reason for the recent drop in oil prices is the market's expectation of OPEC+'s plan to increase oil production in October, as well as signs of weak demand from the world's two major oil consuming countries, which have raised concerns about future consumption growth.

OPEC+is expected to increase oil production by 180000 barrels per day in October as it gradually lifts its production reduction plan. According to well-known sources, this production increase plan has been largely determined, although adjustments may be made in the coming months based on fluctuations in oil prices.

IG market analyst Tony Sycamore said that market concerns about OPEC's production increase in October are an important factor driving down oil prices. He believes that OPEC's final decision will depend on the performance of market prices, especially whether WTI crude oil prices can remain close to $80. If prices continue to remain at a lower level, OPEC may postpone its production increase plan.

On the other hand, market concerns about energy demand have intensified. Although supply disruptions in Libya and geopolitical tensions in the Middle East have provided short-term support to the market, these factors have not reversed the overall downward trend.

According to a report by ANZ Bank, global economic growth may face downward pressure in 2025. If this expectation comes true, OPEC may have to reconsider its production strategy to maintain oil price stability.

On a technical level, WTI crude oil prices showed a clear downward trend at the opening on Monday, falling below the important threshold of $74.00. According to the double top pattern on the chart, the current downward trend has been confirmed and may continue to drop to a low of $72.04 in the near future. This price level will become an important target for the upcoming trading session. Analysis suggests that unless the price can return to above $75.00, there is little possibility of a bullish trend in the short term.

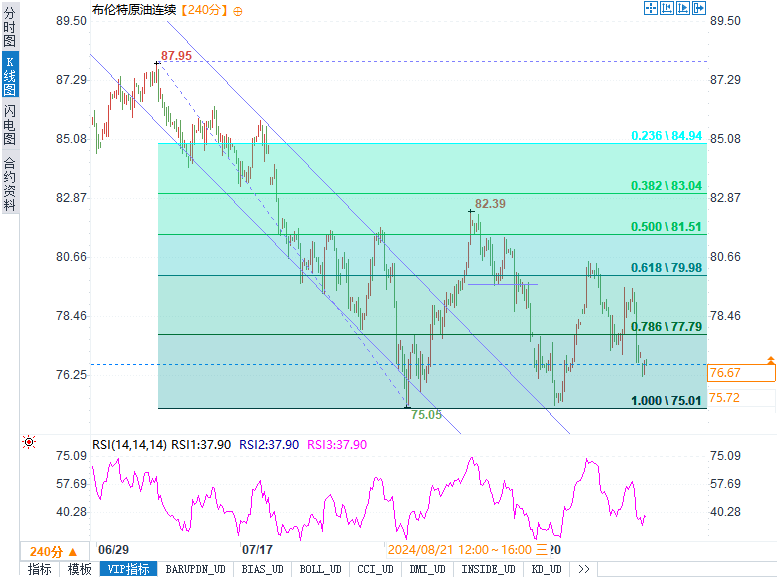

Brent crude oil also shows a bearish trend. After closing below $78.80 last Friday, it further fell on Monday, confirming the completion of the double top pattern. This pattern suggests that the price may further drop to $75.80, or even $74.50. The negative pressure of the 50 day moving average is also intensifying the continuation of this trend. Unless Brent crude oil prices can rise above $77.85, the bearish trend in the market will continue in the short term.

Market prospects and prospects

Looking ahead, the crude oil market remains full of uncertainty. The production increase plan of OPEC+and the demand performance of major economies around the world will continue to dominate the market trend. Although geopolitical factors and supply chain disruptions may provide short-term support for oil prices, in the long run, weak demand and slowing economic growth will continue to put pressure on oil prices.

Therefore, traders should continue to pay attention to the release of global macroeconomic data in the coming trading days, especially economic indicators from the United States, such as ISM manufacturing PMI, ADP employment changes, and non farm employment data. These data will provide clearer direction guidance for the market.

Overall, the volatility of the crude oil market is expected to continue to increase in the short term, and market participants should closely monitor OPEC+'s production policies and the demand performance of major global economies to adjust trading strategies in a timely manner.

The current pressure on the crude oil market mainly comes from OPEC+production expectations and the weak global economic outlook. Technically speaking, both WTI and Brent crude oil have shown a strong downward trend, with a low possibility of a bullish outlook in the short term. In future trading, market volatility is expected to intensify, and traders need to remain highly vigilant, pay attention to changes in key support and resistance levels, and adjust their strategies in a timely manner to cope with market risks.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights