Laurent Maurel, a precious metal investment researcher at Recherche Bay, stated that the significant revision of the US Non Farm Payrolls (NFP) report proves that economic downturns are becoming increasingly difficult to predict. He warned that the gold market is preparing for the second stage tipping point of inflation, and the bullish trend of gold is warning investors that the Federal Reserve is about to make another monetary policy mistake.

Morel wrote on Friday (August 30th): "Two months ago, I wrote that it would be difficult to predict if the US economy fell into a recession, and if analyzed solely based on employment data, it may be even more difficult to predict if the US economy fell into a recession

He emphasized, "I never thought these employment data would be modified to such an extent

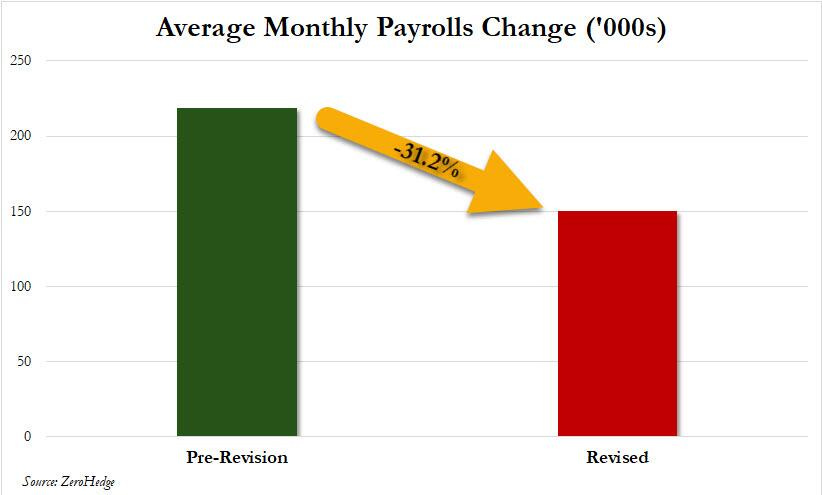

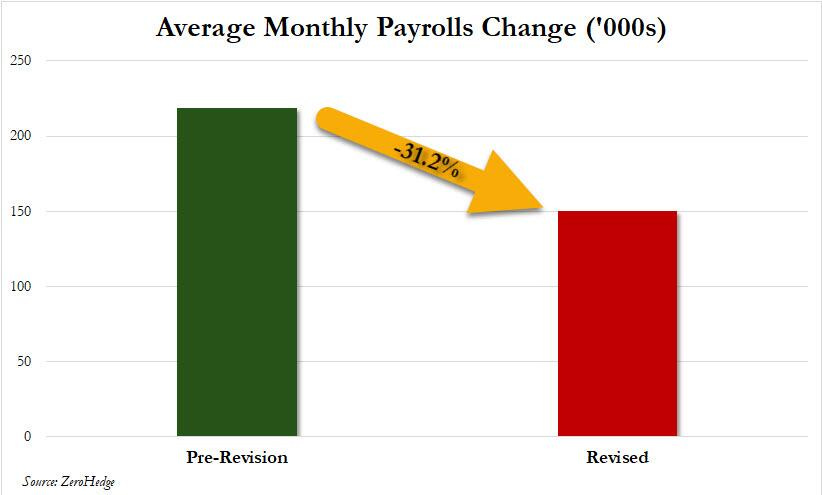

In March of this year, when most economists still believed in the data released by the Biden administration's Bureau of Labor Statistics, analysis showed that the actual number of employed people was overestimated by at least 800000. The recent revisions have confirmed this overestimation, especially in high paying industries such as professional services, leisure, and manufacturing.

(Source: ZeroHedge)

The purpose of this data manipulation is to present an economy that is stronger than it actually is, thereby distorting public perceptions. In fact, the employment growth in 2023 is much milder than initially announced. This is the second largest data revision in US history, and the inaccuracy of US employment data has added further difficulties to the analysis of the real economic situation.

Morel continued, "In this situation, how much confidence do we have in the upcoming employment report next week? Should we expect further data revisions

On the eve of the crucial US election, inflation data may also be manipulated. However, all indicators pointing to the beginning of a new phase of inflation are positive

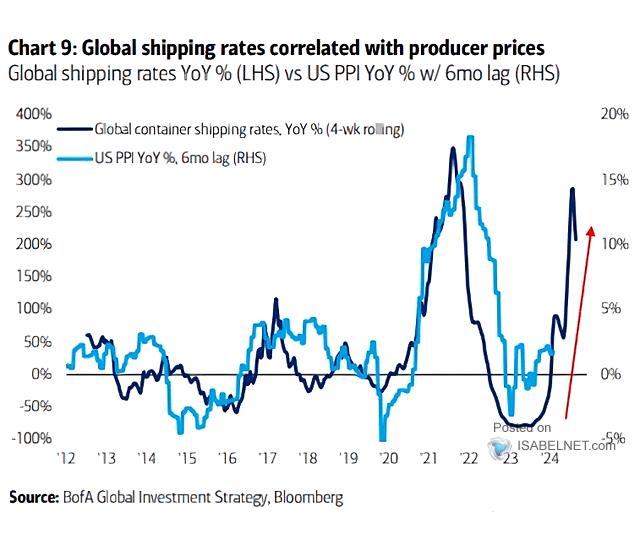

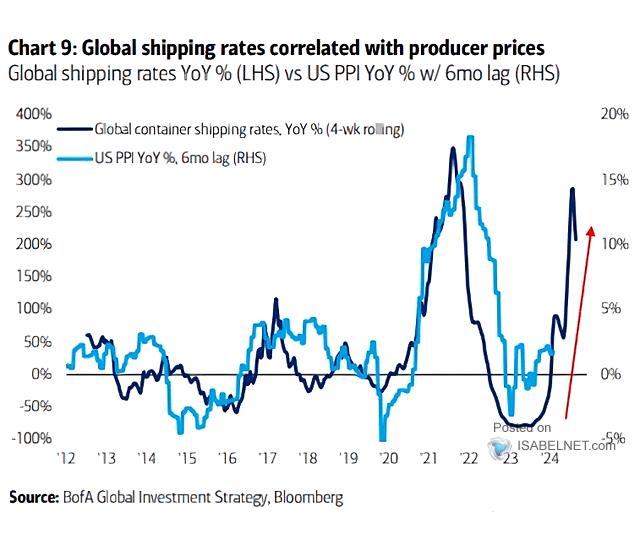

The global increase in freight rates indicates a recovery in the US Producer Price Index (PPI):

(Source: Bloomberg)

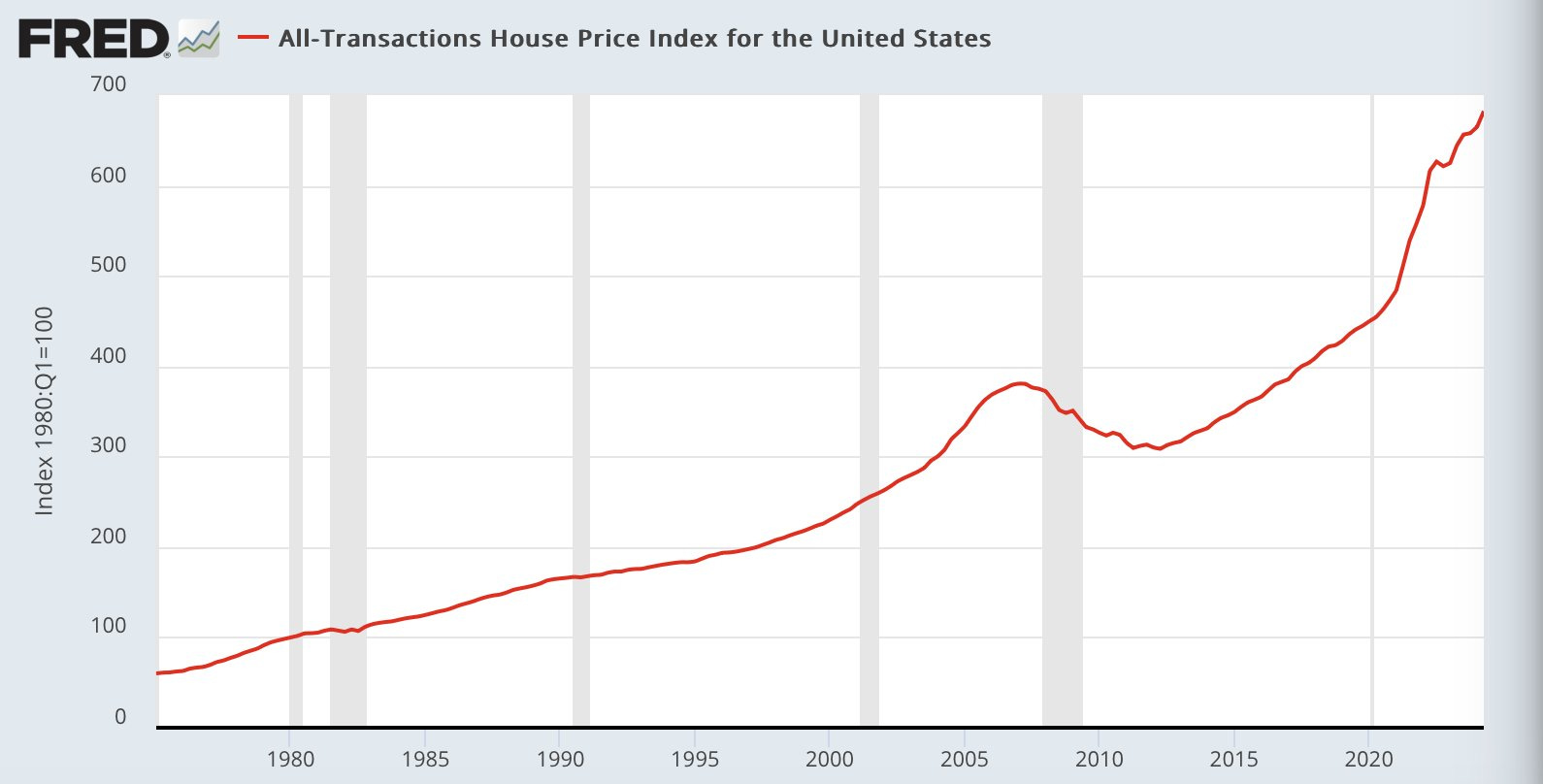

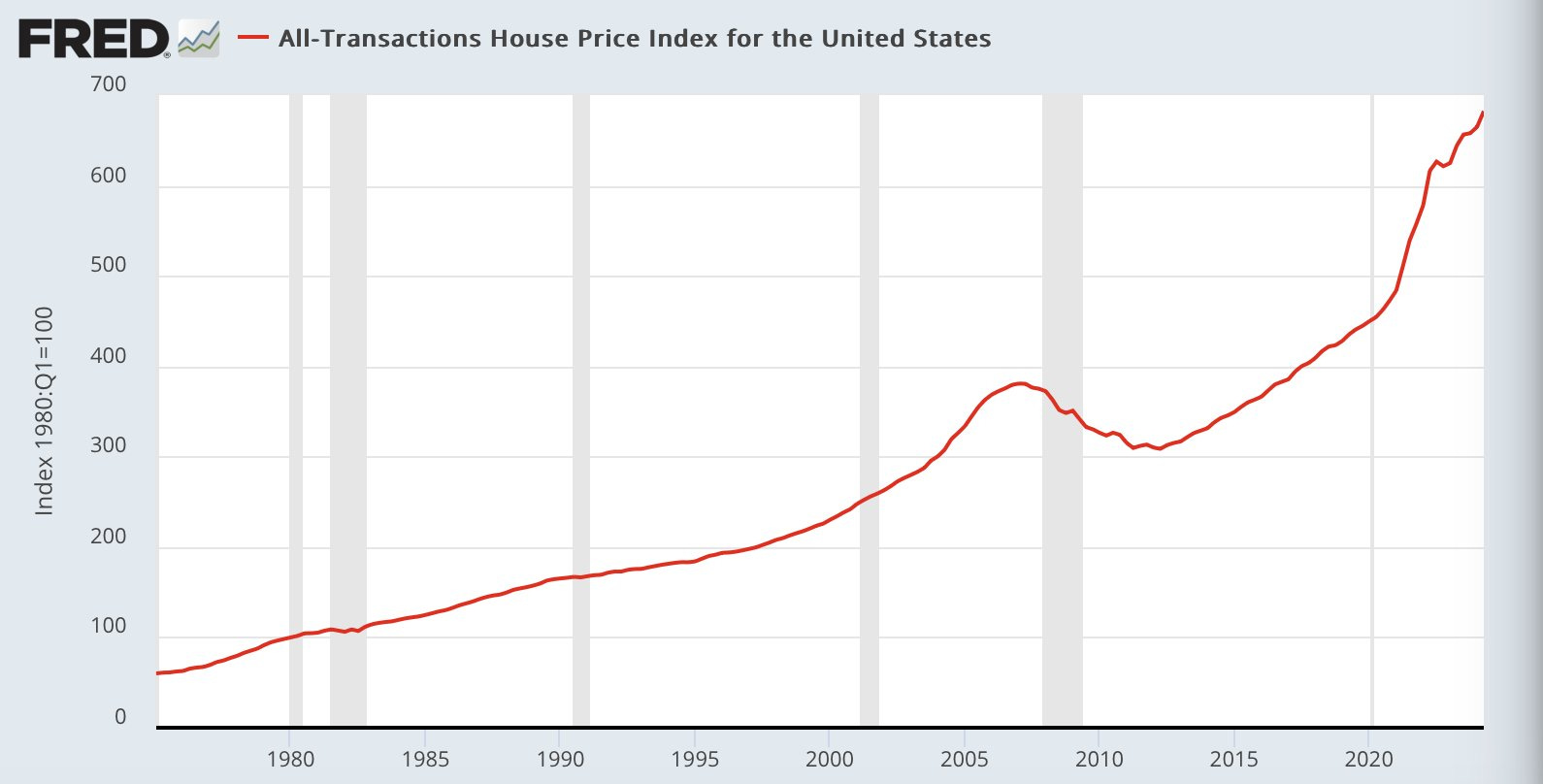

In 2020, the significant increase in these interest rates preceded the sudden recovery of inflation by six months. The battle against inflation is far from won, and the latest sales data for single family homes shows no significant drop in prices:

(Source: FRED)

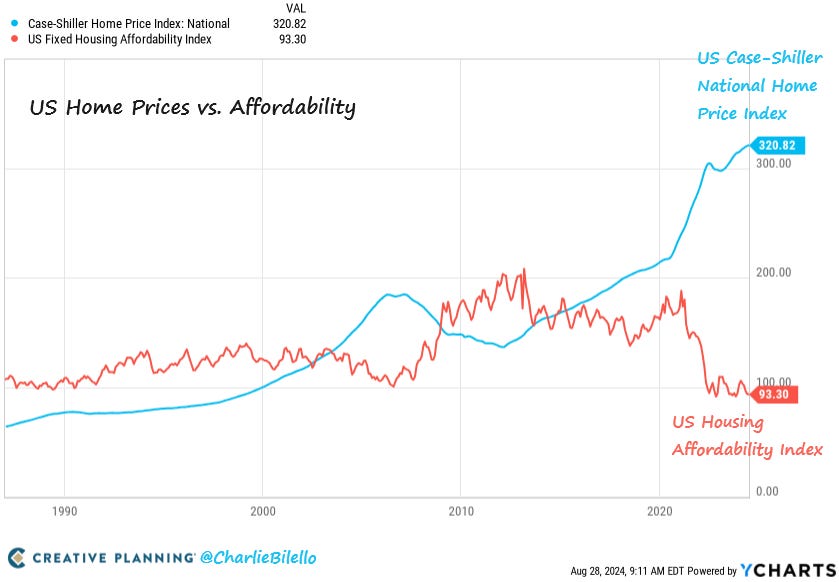

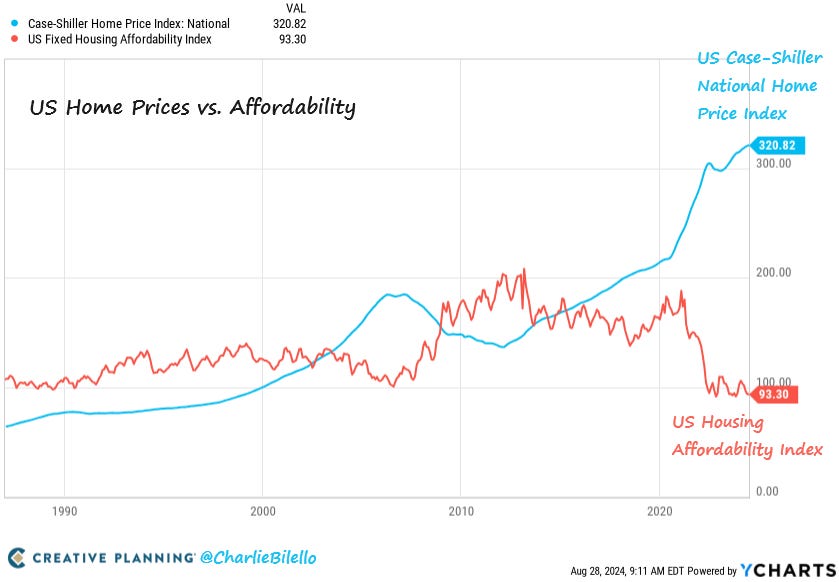

US housing prices are at historic highs, yet owning a home has never been so difficult:

(Source: YCharts)

The latest survey from the

Federal Reserve's Dallas office shows that the construction industry still faces pressure. The prices in the region have not decreased, on the contrary, they continue to rise. For example, a door that was priced at $3000 a year ago is now priced at $10000. Market competition has weakened. The number of local enterprises has decreased, and many have closed down due to difficulties in maintaining labor or the imminent retirement of their owners. Other companies have been acquired. The supply cycle of items such as transformers and generators is still very long.

Some agricultural product prices have also continued to soar, taking coffee as an example, its price has increased fivefold since 2020:

(Source: Trading View)

The inflation rate is still at its highest level in 40 years, but the market currently expects the

Federal Reserve to cut interest rates at its next meeting.

The period of high interest rates seems to have ended, at least according to the bets of many investors. The US money market fund recorded approximately $90 billion in inflows in the first half of August, the highest level since November 2023

(Source: Financial Times)

The total assets of money market funds have reached a historic high of approximately 6.2 trillion US dollars.

Never before has so much capital been invested in these products, and money market fund returns are expected to bring hundreds of billions of dollars in returns to their holders this year, further increasing available liquidity. The tedious work of the central bank to withdraw liquidity from the market is being offset by this self perpetuating liquidity foam.

Morrell said: "The liquidity supply is increasing while the number of available real assets is decreasing. We have all the factors for the recovery of inflation. The conditions are ready, and only one trigger is needed to make things start again. The first wave of inflation was triggered by the COVID-19 crisis."

What will trigger a second round of inflation? Is it really wise to consider cutting interest rates in the face of the risk of inflation resurging

He concluded, "The consecutive record highs in

gold prices tell us that we are about to hit the tipping point of a new round of inflation. Gold warns us that the

Federal Reserve is about to make another monetary policy mistake.