Job vacancy data once helped the gold price return to the 2500 mark, and the 'small non farm' hit hard!

On Wednesday (September 4th) during the US trading session, stimulated by weak US job vacancy data, gold prices rose sharply in the short term, reaching $2500 per ounce at one point. Next, gold traders will receive more job market data and are expected to experience new market trends.

Due to the decline in job vacancy data in the United States, the possibility of a major interest rate cut by the Federal Reserve in September has increased, leading to a weakening of the US dollar and a decrease in US bond yields. As a result, gold prices reversed their upward trend on Wednesday.

On Wednesday during European trading, gold prices fell to $2471.69 per ounce at one point, but then steadily rose. After entering the New York session, the gold price further rose.

Wednesday's data showed that job vacancies in the United States in July fell to their lowest level since early 2021, with an increase in layoffs, consistent with other signs of slowing labor demand.

The Job Openings and Labor Mobility Survey (JOLTS) released by the US Bureau of Labor Statistics on Wednesday showed that the number of job vacancies decreased from 7.91 million in the previous month to 7.67 million. The data is lower than the expectations of all surveyed economists.

The JOLTS job vacancy report is one of the most important labor indicators for US Treasury Secretary Yellen during her tenure as Chair of the Federal Reserve. This indicator is also a highly monitored labor market data by the Federal Reserve.

After the release of poor job vacancy data, gold prices quickly rose to $2500.26 per ounce in the short term, setting a intraday high.

As of Wednesday's close, spot gold rose 0.1% to close at $2495.22 per ounce.

Analyst Christian Borjon Valencia pointed out that gold prices rebounded on Wednesday after hitting a daily low of $2471 per ounce. After the weaker than expected job vacancy data released in the United States increased the possibility of a 50 basis point interest rate cut by the Federal Reserve, gold prices rose in the North American market. Gold was supported by lower US treasury bond yields and a weaker US dollar.

After the data was released, the yield of US treasury bond bonds fell, and the yield of benchmark 10-year treasury bond fell nearly 6 basis points to 3.776%. Traders are increasing their bets on the possibility of a significant interest rate cut by the Federal Reserve. The US Dollar Index (DXY), which tracks the performance of six currencies against the US dollar, fell 0.37% to 101.38.

According to CME's "Federal Reserve Watch" tool, the probability of the Fed raising interest rates by 50 basis points at its September meeting has risen to 43%. The next Federal Open Market Committee (FOMC) meeting will be held on September 17-18.

Thursday's' Small Non Farm 'Heavy Attack

Valencia stated that gold traders are preparing for a new round of US employment data. The US ADP employment changes, initial jobless claims, and non farm payroll reports will be released later this week.

The expected increase in ADP employment in August in the United States is expected to rise from 122000 in July to 150000.

In addition, the growth rate of non farm payroll employment in the United States in August is expected to rise from 114000 to 163000, while the unemployment rate may decrease from 4.3% to 4.2%.

If the US employment report is significantly weak, speculation about a US economic recession and faster interest rate cuts will resurface, further supporting gold prices, "said analysts at Commerzbank

David Meger, Director of Metal Trading at High Ridge Futures, stated that job vacancy data indicates a slight slowdown in the US economy, leading to a pullback in the US dollar and continued decline in interest rates, which provides support for the gold market. In addition, the "small non farm" ADP employment and initial jobless claims report to be released on Thursday, as well as Friday's non farm employment report, will also be closely monitored, and the market will use this to find clues about the path of the Federal Reserve's interest rate cut.

Peter A. Grant, Vice President and Senior Metals Strategist at Zaner Metals, stated that the market expects a 100 basis point rate cut before the end of the year, which means one of the next three FOMC meetings will cut interest rates by 50 basis points, but it is unlikely to be the first meeting.

Non interest bearing gold often thrives in low interest rate environments.

How to trade gold?

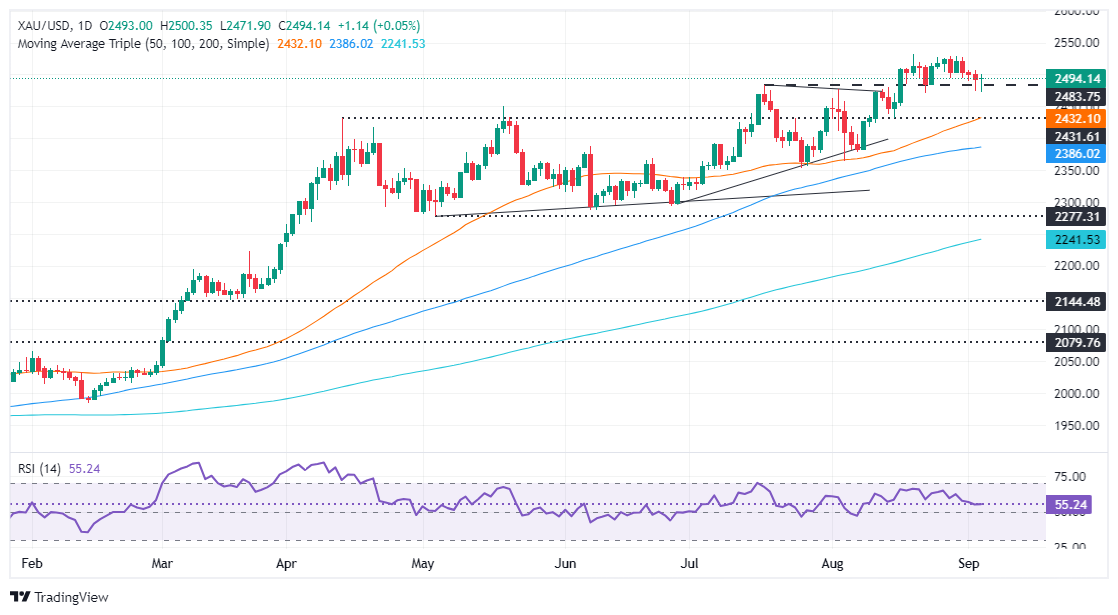

Valencia pointed out that with the appearance of the "tweezers bottom" pattern, the upward trend of gold prices resumed on Wednesday, but buyers need to clear a key resistance level. If so, gold prices may once again test the high point of the year to date.

The momentum measured by the Relative Strength Index (RSI) suggests that buyers are in control of the market, but tend to level off in the short term.

Valencia stated that if the daily closing price of gold is above $2500 per ounce, the next resistance level will be the historical high of $2531 per ounce, followed by the $2550 per ounce mark. Once it breaks through the latter, the gold price will aim at $2600 per ounce.

(Daily chart of spot gold)

Valencia added that, on the contrary, if gold prices remain below $2500 per ounce, the next support level will be the August 22 low of $2470 per ounce.

If it falls below $2470 per ounce, the next support area for gold prices will be at the confluence of the April 12th high turning support level and the 50 day simple moving average (SMA), around $2431 per ounce.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights