This year, India's gold demand will remain strong, and the gold price is expected to rise to $2500!

Soni Kumari and Daniel Hynes, commodity strategists at ANZ Bank, stated in a recent report that they expect strong gold demand in India this year, which may continue to support gold prices in the second half of the year.

Our calculations indicate that for every 1% increase in gold prices, gold demand tends to decrease by 0.6%. Price increases are still suppressing demand, but sensitivity has decreased over the past year. Although gold prices have risen by more than 10% in 2023, consumer demand remains strong at 760 tons, with only a slight decrease of 2% year-on-year. Demand is also in line with the long-term (2013-22) average of 755 tons

ANZ Bank added that in the first five months of this year, India's gold imports increased by 26% year-on-year to 230 tons, despite the gold price hitting a record high above $2450 per ounce.

Kumari and Hynes said that the structural transformation of the Indian economy is helping to support demand for physical gold, even though gold prices remain high. Due to the fact that India's gold demand is mainly driven by physical demand, especially jewelry demand, the increase in per capita income will be a key long-term driving factor. The country is at the forefront of economic expansion, and it is expected that per capita income will increase by more than 60% to reach $4000 by 2030. There are other demographic changes, such as urbanization, an increase in middle-income groups, and a decrease in dependence, which may offset any negative impact of high gold prices.

At the same time, while driving recent demand, the strong monsoon season between June and September will mean that farmers will see higher crop yields and have more money to buy more gold.

ANZ Bank stated that people are increasingly expecting the government to start reducing gold import fees, which will help lower some costs and improve consumer demand.

In addition, the Reserve Bank of India has also begun to diversify its foreign exchange reserves and purchase more gold. The central bank purchased 37 tons of gold in the first half of this year.

Kumari and Hynes pointed out, "The Reserve Bank of India has become the second largest buyer of gold this year. The purchasing volume in the first half of the year means that if the purchasing speed continues, the total purchasing volume this year may reach over 70 tons

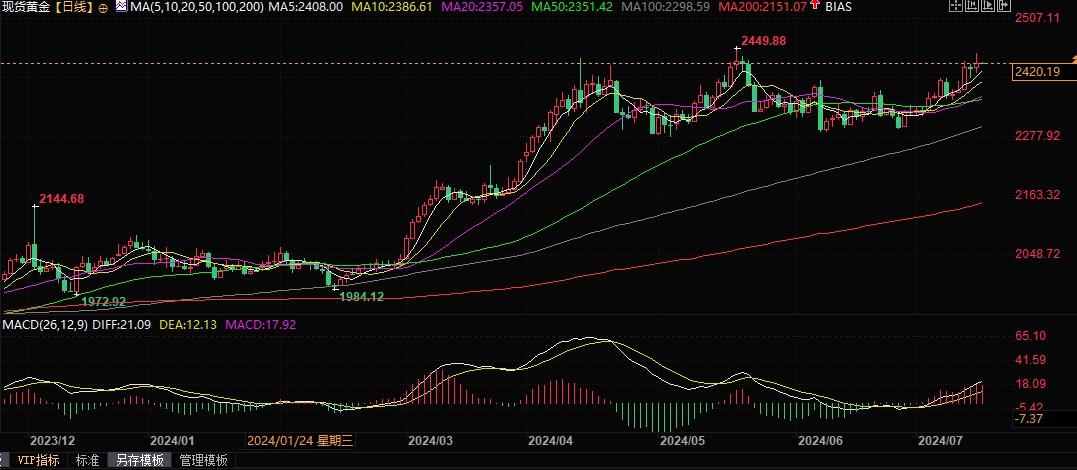

In this environment, as Asian powers such as India continue to play a significant role in the gold market, Kumari and Hynes predict that gold prices will rise to $2500 per ounce by the end of this year.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights